Save 50% on a 3-month Digiday+ membership. Ends Dec 5.

Future of TV Briefing: How the future of TV shaped up in 2022

This Future of TV Briefing covers the latest in streaming and TV for Digiday+ members and is distributed over email every Wednesday at 10 a.m. ET. More from the series →

This week’s Future of TV Briefing looks back at the big trends and developments in the TV, streaming and digital video landscape in 2022.

- What a year

- Streaming adds to TV watch time lead

- The backstory on Bob v. Bob, Apple exits NFL Sunday Ticket talks and more

What a year

The key hits:

- Streaming entered an era of austerity.

- Advertising took a nosedive.

- Netflix added ads.

- Short-form video platforms started to share revenue.

- Measurement remains a mess.

Seriously, what the hell happened this year? Are any of us even old enough to remember January?

At the start of the year, the big focuses for the TV, streaming and digital video industry were slowing subscriber growth for streaming services, creator funds for short-form platforms and new measurement currencies for TV advertising. Then we entered bizarro world. Netflix added ads; TikTok and YouTube Shorts actually introduced revenue-sharing programs; Bob Iger returned; CNN+ pulled a Quibi. At least there was some stability to be found in measurement remaining a mess.

As yet another weird year comes to a close, here’s a time capsule of five top trends and developments in 2023.

Streaming entered an era of austerity

The streaming wave of 2020 that ebbed into a subscriber slowdown in 2021 crashed into a profitability problem in 2022. After years of investing hundreds of millions and billions of dollars in building their streaming services, companies including Disney, NBCUniversal, Paramount and Warner Bros. Discovery faced increased pressure on proving returns on that investment — and not in the form of subscriber counts.

In his welcome Q&A with Disney employees after returning as CEO, Iger said the company needed to pivot its focus from growing subscribers to achieving profitability. Meanwhile, others like Netflix and Warner Bros. Discovery constrained their programming budgets in the face of rising production costs, interest rates and inflation.

As production and development executives said during Digiday’s Future of TV Programming Forum in November, the market for TV and streaming shows is in a correction period. “The market is definitely very tight right now. A lot of decisions are being driven by costs. There’s consolidation happening across the board in our business. So we’re definitely seeing less buys,” said Jo Sharon, co-CEO of production company Magical Elves.

Money matters weren’t limited to the economics of streaming programming, though.

Advertising took a nosedive

After a bounce-back year in 2021, TV and streaming ad revenues hit a wall in the second half of 2022.

Worries over the economy’s deterioration began to bubble up just as TV and streaming ad buyers and sellers approached the annual upfront cycle in late spring. Then matters worsened over the summer, to the point that advertisers revised down their upfront commitments when it came time to place their orders in September.

The hits weren’t limited to traditional TV. In the third quarter, YouTube reported its first year-over-year quarterly ad revenue decline since Google began reporting the video platform’s revenue in 2019.

Roku CEO Anthony Wood sounded an ominous note in November when, during the company’s third-quarter earnings call, he shared his outlook for what is usually the ad market’s biggest period. “We are seeing signs that Q4 is going to be worse in terms of the ad market than Q3 was,” he said.

Netflix added ads

Industry executives got to proclaim themselves prophets when Netflix finally entered the advertising business this year — helluva time to do, given the above.

The dominant subscription-based streamer quickly raced to stand up an ad-supported tier. It signed a deal with Microsoft to provide ad tech and ad sales support and began pitching advertisers and agencies before finally hiring Snap’s business chief Jeremi Gorman to oversee its advertising business, with Snap sales exec Peter Naylor joining as her deputy. Then in November, Netflix’s ad-supported tier rolled out with hundreds of advertisers on board, including Anheuser-Busch InBev and L’Oreal.

But a little more than a month later, Netflix’s advertising business hit a rough patch. Ad-supported viewership was coming up short of expectations, and the company started allowing advertisers to take their money back, though some opted to stick their spending with Netflix and shift their dollars to 2023.

Of course, Netflix wasn’t the only notable new addition to the TV and streaming ad market. Disney actually beat Netflix to the punch in announcing Disney+’s ad-supported tier in March, though that tier launched a month later than Netflix’s. And then Apple prepped its streaming advertising play by teasing out its plans with ad buyers and eventually pitching them on ads that will air during its Major League Soccer streams starting in February — a month that will feature the debut of another notable ad program.

Short-form video platforms started to share revenue

Technically, YouTube won’t launch its ad revenue-sharing program for Shorts until February, but we can consider the introduction of direct monetization options on short-form video platforms to be a 2022 development.

TikTok kicked off the trend in May when it unveiled its ad revenue-sharing program Pulse. That program offered the first look at how short-form video platforms will try to tackle the challenge of calculating how revenue should be shared when ads are inserted between videos. In TikTok’s case, it’s effectively attaching ads as post-roll placements.

In September, YouTube followed suit by announcing the Shorts revenue-sharing program, though the platform is taking a different, somewhat controversial approach to calculating rev-shares by pooling revenue and then splitting it among eligible creators and publishers.

Considering that TikTok’s program is still opening up to creators and YouTube’s has yet to launch, the impacts have yet to be seen, and the question remains of how will Instagram respond with Reels. It can hardly afford not to.

Measurement remains a mess

For all that changed in 2022, TV advertising measurement seems to be one area where the industry is ending the year roughly where it started. TV networks, advertisers and agencies are assessing measurement providers to determine which — and how many — they should support as currencies for transactions.

To be clear, the measurement shift did not sit in stasis this year. TV ad buyers and sellers headed into this year’s upfront market planning to adopt alternative measurement providers as “shadow currencies,” and they did so — in order to set baselines to eventually support them as actual currencies.

Nielsen remained the primary currency this year, though organizations like NBCUniversal was able to evolve beyond the traditional age-and-gender-based measure for 40% of its upfront deals. Nonetheless, Nielsen’s position was protected — if only temporarily — by the “test and learn” phase leading TV networks and agencies to learn how much more testing is needed to suss out the various measurement providers.

How much the state of TV ad measurement will change in 2023 remains up in the air. But change will come. It always does.

What we’ve heard

“They can’t deliver. They don’t have enough inventory to deliver. So they’re literally giving the money back.”

— Agency executive on Netflix’s ad-supported tier so far

Streaming adds to TV watch time lead

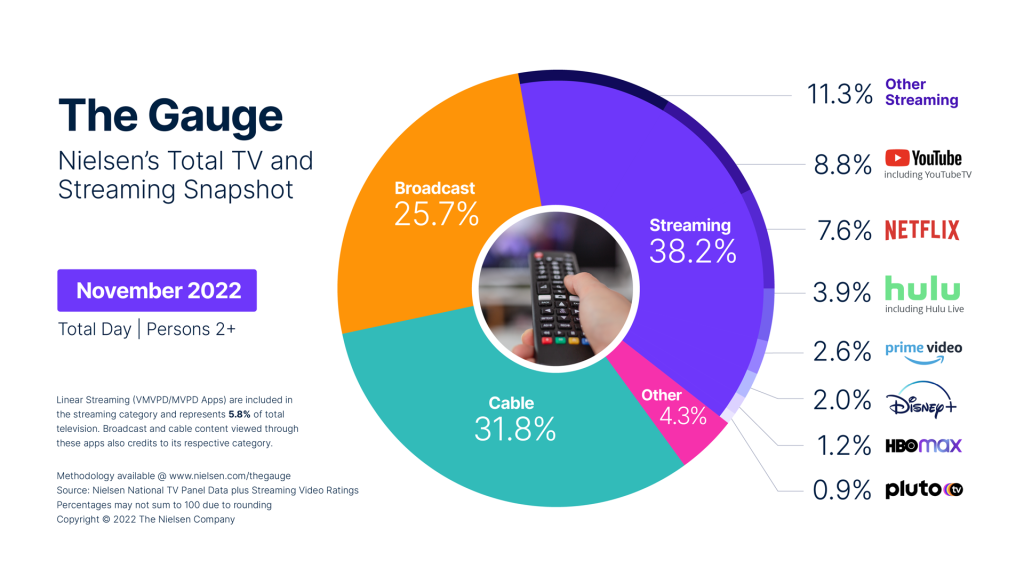

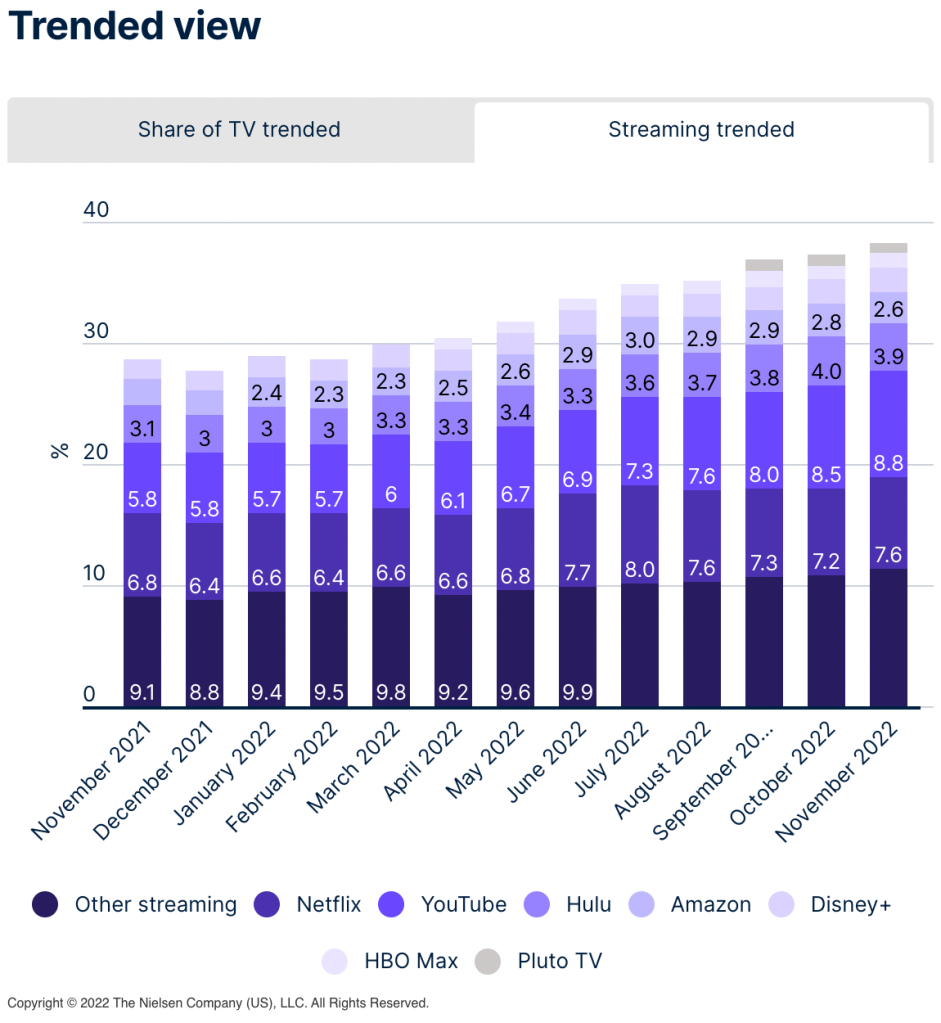

After overtaking cable TV’s total TV watch time lead in July, streaming has only increased its advantage in the ensuring months. In November, the amount of time people spent watching streaming services increased by 10.2% month over month, compared to 6.7% for broadcast TV and 4.2% for cable TV, according to Nielsen’s most recent The Gauge viewership report.

A similar story of lead-building has played out within the streaming market. YouTube usurped Netflix’s position as streaming’s watch-time leader in September, and in November, YouTube stole an additional 0.3 percentage points, though Netflix closed the gap by 0.1 percentage point.

Another notable streaming stat is the share of viewership represented by streaming pay-TV services (YouTube TV, Sling TV, Hulu’s live TV service, etc.). “Viewing of live TV via streaming apps (linear streaming) represented 5.8% of total TV in November (up from 5.7%) and 15.2% of all streaming,” according to Nielsen.

Numbers to know

-7%: Percentage decline year over year in the number of people of color who appeared in TV and video ads.

1: Year that Verizon customers will receive Netflix subscriptions for free if they buy a subscription to another service through the telecom giant’s +play bundle.

10%: Share of CNN’s overall profits that came from its digital business at its peak.

89%: Percentage share of brand and retail professionals who said their companies have used influencers in holiday marketing this year.

What we’ve covered

Here are the hidden costs of being a creator:

- Costs for computers, microphones and editing software subscriptions add up.

- Non-financial costs like time management are also considerations.

Read more about creators’ costs here.

Netflix lets advertisers take their money back after missing viewership targets:

- Netflix has only delivered roughly 80% of the expected audience for some advertisers.

- While some advertisers are taking their money back, others are shifting dollars to 2023 but keeping them with Netflix.

Read more about Netflix’s ad business here.

Three YouTube stars join forces to form their own talent management company:

- Charles “MoistCr1TiKaL” White, Gina “Gibi ASMR” Klein and Tyler “Jimmy Here” Collins have founded Mana Talent Group.

- The move is the latest example of creators forming their own talent management firms.

Read more about the YouTubers’ startup here.

What we’re reading

The backstory on Bob v. Bob:

Bob Iger’s dissatisfaction with Bob Chapek’s stewardship of Disney has been well reported, but this report by The Wall Street Journal sheds light Disney CFO Christine McCarthy’s central role in bringing back Iger and ousting Chapek.

Apple exits NFL Sunday Ticket talks:

Apple has decided to step back from bidding to acquire the NFL’s Sunday Ticket package, leaving Amazon and Google as the frontrunners, according to Puck.

The streaming war turns cold:

The shift in focus among major streaming services from growing subscribers to managing costs is throwing cold water on the competition for audiences, according to The Verge.

HBO Max inserts ads in original shows:

There are no sacred cows in Warner Bros. Discovery’s financial overhaul, which will see the company slot ads in HBO originals streaming on HBO Max, according to Insider.

AMC Networks is TV’s canary in the coal mine:

AMC Networks’ financial issues despite its streaming progress underscores the challenge facing all TV networks as the traditional TV business continues to take on water but streaming is not yet a big enough lifeboat, according to The New York Times.

More in Future of TV

Future of TV Briefing: The streaming ad upfront trends, programmatic priorities revealed in Q3 2025 earnings reports

This week’s Future of TV Briefing looks at what TV and streaming companies’ latest quarterly earnings report indicate about the state of the streaming ad market.

Future of TV Briefing: The creator economy needs a new currency for brand deals

This week’s Future of TV Briefing looks at why paying creators based on reach misses the mark and what IAB is doing to clear up the creator-brand currency situation.

Future of TV Briefing: WTF is IAB Tech Lab’s device attestation tactic to combat CTV ad fraud?

This week’s Future of TV Briefing breaks down the CTV ad industry’s new tool for fighting device spoofing.

Ad position: web_bfu