Save 50% on a 3-month Digiday+ membership. Ends Dec 5.

Future of TV Briefing: TV advertising’s measurement landscape remains in a state of upheaval

This Future of TV Briefing covers the latest in streaming and TV for Digiday+ members and is distributed over email every Wednesday at 10 a.m. ET. More from the series →

This week’s Future of TV Briefing checks in on where the TV advertising industry’s measurement shift stands heading into the new season.

- Taking measure

- Smart TV’s share of streaming watch time

- Amazon’s enigmatic entertainment arm, Twitch’s loosened grip, Netflix’s cost-cutting and more

Taking measure

The key hits:

- TV networks and agencies are bogged down by measurement providers’ movable methodologies.

- Nielsen’s updated measurement system has suffered a setback.

- A shortlist of measurement providers has emerged.

“Test and learn” continues to be the aptest descriptor for the current status of the TV advertising industry’s measurement currency changeover. As TV networks, advertisers and agencies continue to test alternative measurements to eventually transact against, they are learning how much work still needs to be done for these measurements to be ready for primetime.

“Honestly, what’s happening is, even in some of these tests that we’re doing right now, the methodologies are changing mid-campaign,” said one TV network executive.

Disparities in methodologies and results among measurement providers had originally slowed the measurement shift in the spring. They were a factor in advertisers and agencies opting to primarily stick with Nielsen as the measurement currency for this year’s upfront deals, despite the measurement provider losing its Media Rating Council accreditation and opening the door to rivals like Comscore, iSpot.tv and VideoAmp. Coming out of the upfront marketplace, the measurement shift seems to be bogged down by these same issues as TV ad buyers and sellers have gotten more aggressive in vetting the measurement providers in light of the disparities.

“There are a few key priorities, as we continue to shift, that we’re seeing in the marketplace. First is education, especially on providers’ methodology and understanding what a measurement partner’s capabilities are,” said a second TV network executive.

“I have had conversations with research heads on the agency side who have shared pretty directly that they have huge concerns around the fact that one plus one doesn’t seem to equal two when they’re looking at what is supposed to be apples to apples,” said a third TV network executive.

“When you’re looking at counting impressions, you should be able to do it at all levels. That’s the ultimate goal. So it’s just so nascent right now that the overall capability is lacking,” said an agency executive.

Case in point: Two TV network executives interviewed for this article said they have had experiences in which a non-Nielsen measurement provider changed its methodology while an advertiser’s campaign was running; the executives asked to keep the provider’s names anonymous to protect the identities of the executives and their networks as well as their relations with the providers. These methodology changes have included the size of the audience that the provider is capable of measuring.

In one case, a TV network and an advertiser had been running a cross-platform measurement test with a provider, and during the campaign, the provider informed the network that it didn’t have the capability to measure the campaign’s digital audience, according to one of the TV network executives.

Meanwhile, Nielsen has run into its own issues. The measurement provider had planned to start rolling outs its updated measurement system, Nielsen One, in the fall, but last month the company notified advertisers that the system — which will incorporate data from set-top boxes and smart TVs in addition to Nielsen’s legacy panel-based measurement — was not ready to be used as the basis for transactions.

That delay lowered confidence among TV network and agency executives that Nielsen One will be ready to transact against in the first quarter of next year, which will be a prime testing period as ad buyers sort out their strategies for next year’s upfront negotiations, the executives said. “They missed their pilot in August. They still have not started their betas with the agencies,” said a second agency executive.

Despite all the setbacks, progress is being made, according to TV network and agency executives. For example, 40% of NBCUniversal’s upfront deals signed this year are using measurements other than Nielsen’s traditional age-and-gender metric, as advertisers adopt advanced audience segments to target households based on data like household members’ interests and purchase patterns. And while Nielsen retained its status as the primary currency in this year’s upfront deals, advertisers and agencies did seed other providers as secondary measurements to establish baselines for eventually using them as currencies. And in some cases, they added tertiary measurement providers to serve as a system for checks and balances.

“It’s extremely important to have a secondary currency measurement in place, even on the alternative currency. You bought on a Nielsen guarantee, you’re testing on different currency provider, but you also want to have an alternative,” said Geoffrey Calabrese, chief investment officer at Omnicom Media Group. “So essentially, you want multiple currency tests happening at the same time to check the effectiveness versus Nielsen and to each other.”

Furthermore, while every measurement provider — including Nielsen — appears to be having methodology issues, a shortlist of providers has emerged with Nielsen, iSpot.TV, Comscore and VideoAmp being the four that the executives interviewed for this article are zeroing in on. “And I think in that order. That would be the order I would put it in if you said ‘prioritize,’” said the third TV network executive.

“I never think we’ll be at one [measurement provider only]. I want to make sure we’re clear on that, and I kind of like that. But yeah, it’s VideoAmp, iSpot, Comscore, Nielsen One,” said the first agency executive.

Bottom line: The measurement currency changeover is happening. In one basic respect, it has to.

“Nielsen has announced that C-3 and C-7 [its legacy metrics for measuring viewership within three and seven days of a show’s original airing] will go away in 2024. So there will be 100% new currencies come 2024,” said the second TV network executive.

What we’ve heard

“[Upfront orders are] coming in light and being cut substantially…. When we were negotiating, there was a lot of confidence in the money. Then over the last few weeks, that’s drastically changed.”

— Agency executive on advertisers reducing their TV upfront commitments

Smart TV’s share of streaming watch time

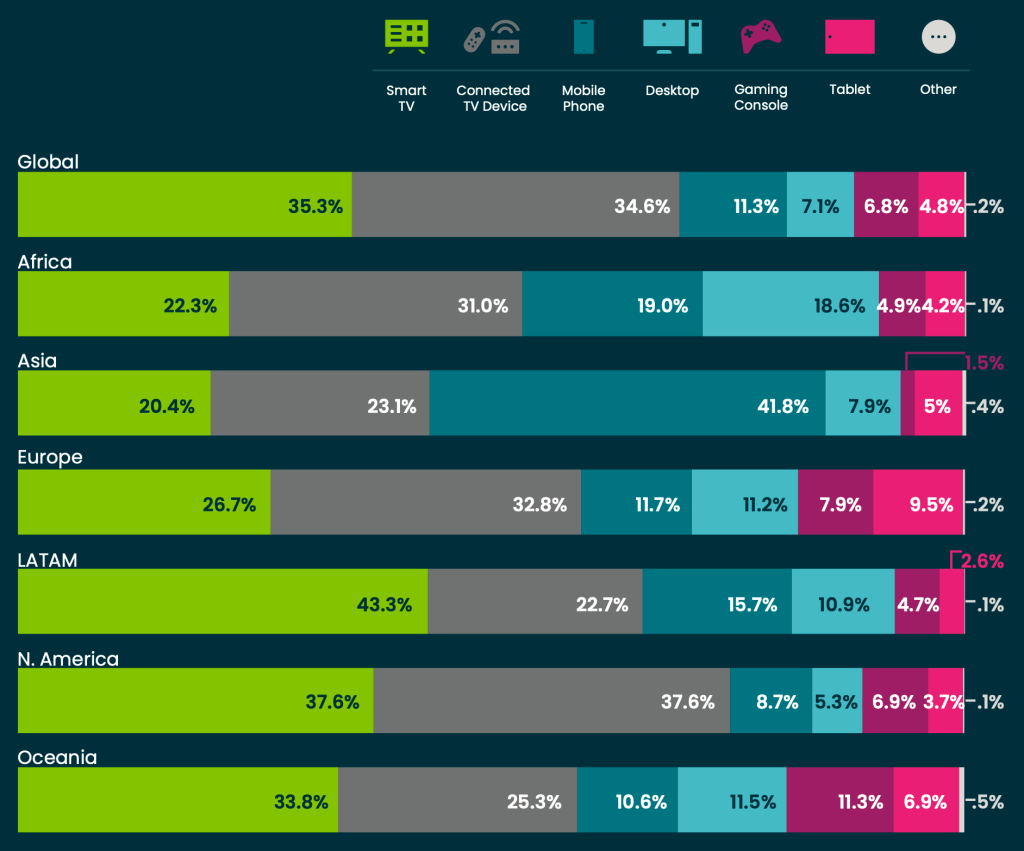

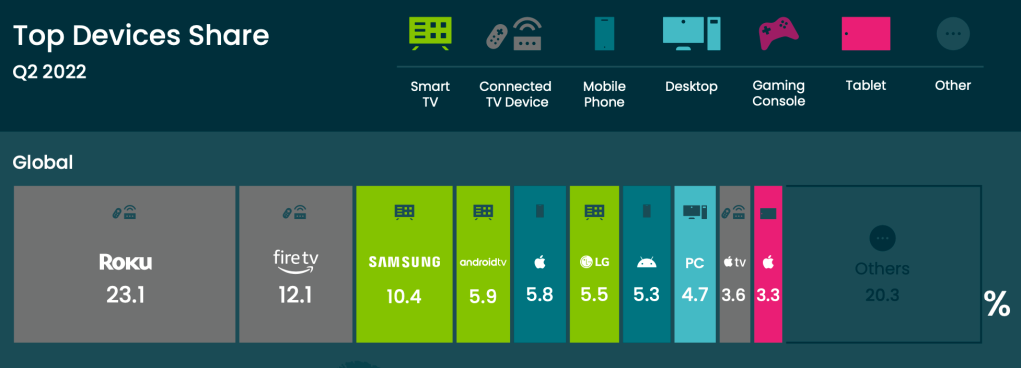

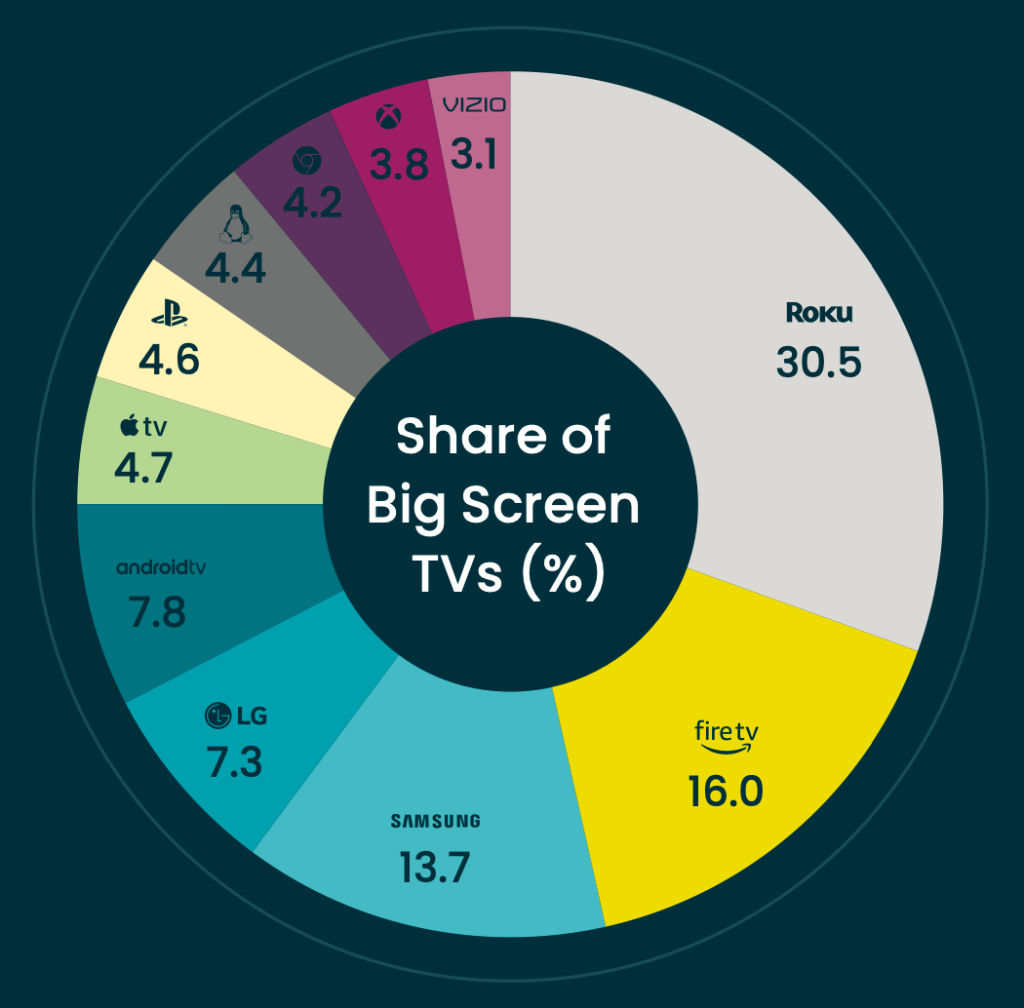

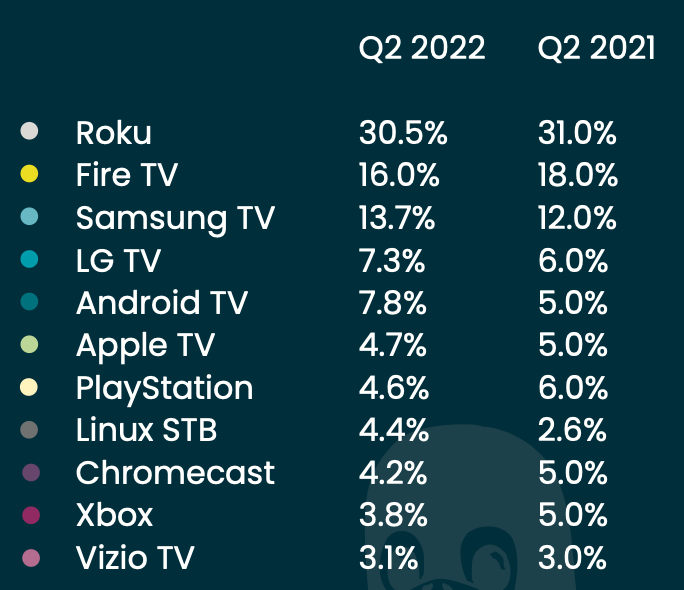

Smart TVs have become the most popular device type that people use to streaming shows and movies, according to Conviva’s “State of Streaming” report for the second quarter of 2022. Nonetheless, Roku and Amazon still corner the TV screen market.

Smart TV’s increased usage in Q2 contrasts with the fact that smart TV sales have been hampered by supply-chain issues. Smart TV maker Vizio, for example, reported hardware sales had flatted from Q1 2022 to Q2 2022.

Smart TVs surpassing connected TV devices — i.e. TVs that use a CTV device like a Roku streaming stick or Apple TV puck to access streaming services — doesn’t mean that smart TV platform owners like Samsung and Vizio have overtaken CTV platform owners like Roku and Amazon for viewership share, however. In fact, Roku’s and Amazon’s CTV platforms — which are built into some smart TVs — still combine to account for more than a third of global streaming watch time in Q2.

Additionally, nearly half of the time people spent streaming shows and movies on a TV screen occurred on TVs that were powered by either Roku’s and Amazon’s CTV platform.

That being said, the CTV duopoly of Roku and Amazon do not have as much of a stranglehold on the TV screen as they once did. Both platforms saw their share of streaming viewership on TV screens slip year over year, albeit only by less than two percentage points in either case.

Amazon’s and Roku’s grasp could loosen further with smart TV sales predicted to rebound by the end of this year to grow by 1.9% in 2022, per Kagan. Then again, a healthy share of those smart TVs may be powered by the two companies’ CTV platforms.

Numbers to know

$7 million: How much Fox is charging for ad slots in next year’s Super Bowl broadcast.

1%: Percentage share of characters in popular TV series in the U.S., U.K., Australia and New Zealand in 2019 who were Muslim.

17.6 million: Number of hours per day that Instagram users cumulatively are spending watching Reels, compared to 197.8 million hours they spend watching TikTok videos daily.

38%: Percentage share of Vizio smart TV owners who use a traditional pay-TV service.

>$4 million: How much money Amazon will pay for residuals and interest owed to screenwriters of films that the e-commerce giant had produced or acquired.

What we’ve covered

As ad budgets are slashed in the absence of cash, marketers are ‘bartering’ influencers:

- Some brands are asking to compensate influencers with gifts instead of payments.

- The barter proposals are primarily affecting influencers with smaller followings.

Read more about brands’ influencer bartering here.

Marketers look to TikTok’s new video ad offerings ahead of this year’s busy holiday shopping season:

- TikTok will let advertisers link their products to in-feed videos and place clickable ads in live videos.

- The platform is testing video shopping ads in the U.S. and U.K. with a limited number of advertisers.

Read more about TikTok’s video ad products here.

How G Fuel’s toxic working environment made the energy drink brand’s influencer marketers jump ship:

- Five G Fuel talent managers reported the company’s CEO to HR for using offensive language to describe employees.

- The next day G Fuel let go of all five talent managers and two more.

Read more about G Fuel’s toxic workplace here.

What we’re reading

Amazon’s enigmatic entertainment arm:

Amazon will spend roughly as much on programming this year as Netflix, and yet the e-commerce giant’s streaming business doesn’t garner as much attention as its rivals, though that may be changing, according to Bloomberg.

Twitch’s loosened grip on top streamers:

Top Twitch streamers including Imane “Pokimane” Anys and Tyler “Ninja” Blevins are no longer limiting themselves to live-streaming on the Amazon-owned video platform, which has also been relaxing its exclusivity arrangements with streamers, according to The Washington Post.

Netflix’s cost-cutting:

Netflix is taking a red pen to its balance sheet by looking to reduce its computing costs, hiring lower-salaried junior employees and cutting back on employee perks like company merchandise orders, according to The Wall Street Journal.

Snap’s rebound plan:

After laying off 20% of its employees and cutting its original programming business, Snap is looking to attract more 30- to -40-year-olds to its platform as part of a plan to turn around its business in 2023, according to The Verge.

CNBC’s and Salesforce’s sponsored TV show:

Salesforce and CNBC’s branded content studio are producing a TV show that will air on CNBC as part of the enterprise software provider’s sponsorship deal with NBCUniversal signed last year, according to Axios.

More in Future of TV

Future of TV Briefing: The streaming ad upfront trends, programmatic priorities revealed in Q3 2025 earnings reports

This week’s Future of TV Briefing looks at what TV and streaming companies’ latest quarterly earnings report indicate about the state of the streaming ad market.

Future of TV Briefing: The creator economy needs a new currency for brand deals

This week’s Future of TV Briefing looks at why paying creators based on reach misses the mark and what IAB is doing to clear up the creator-brand currency situation.

Future of TV Briefing: WTF is IAB Tech Lab’s device attestation tactic to combat CTV ad fraud?

This week’s Future of TV Briefing breaks down the CTV ad industry’s new tool for fighting device spoofing.

Ad position: web_bfu