Save 50% on a 3-month Digiday+ membership. Ends Dec 5.

Media Briefing: How Axios, Bloomberg and Semafor grew their events revenue in 2023

This Media Briefing covers the latest in media trends for Digiday+ members and is distributed over email every Thursday at 10 a.m. ET. More from the series →

This week’s Media Briefing looks at how professional publishers increased their events revenue between 48-60% this year, despite a dreary ad market.

- Event revenue prevails for professional publishers

- Venture capital funding to publishers tanks in Q3

- The Wall Street Journal’s new top editor kicks up dust, CNN’s new CEO rattles the staff and more

Event revenue prevails for professional publishers

At the start of 2023, it was hard for many publishers to predict how event sponsorship revenue — or ad revenue as a whole for that matter — would pan out for the year.

Some publishers, like Apartment Therapy and Forbes, went as far as pushing back the timelines for their tentpole event franchises in order to elongate the selling period and give advertisers a bit more time to find room for big-ticket event sponsorships within their budgets. But entering into the final quarter of 2023, it seems that publishers, particularly in the business/professional sector, made out just fine this year after all.

Ad position: web_incontent_pos1

Take Axios, for example, which started 2023 with a goal of earning $10 million in events sponsorship revenue by year’s end. Not only did the company exceed its goal in Q3, but by the end of Q4, Axios’s annual events revenue is expected to increase by 60% year over year, according to Jacquelyn L. Cameron, svp of client partnerships and subscriptions at Axios. She would not disclose exactly how much event revenue the company is planning to end the year with now.

Bloomberg Media is also up 48% year over year in event revenue, despite slightly decreasing the total volume of events within its events slate between 2022 and 2023, according to Jessica Webber, global head of Bloomberg Live Experiences. She declined to share exact revenue numbers for the business.

And Semafor, which is approaching its one-year anniversary next week, has hosted 40 events since its launch and that business has been “pacing above what we expected,” said CRO Rachel Oppenheim. While she would not disclose the exact amount of revenue that’s been earned by the events business, half of the company’s total revenue — in the 8-figure range, which is a threshold it surpassed as of May this year, according to a report by The New York Times — comes from events. And events have been central to doubling the total client base the company launched with, Oppenheim added, without disclosing the exact number.

But not all publisher events businesses are feeling this healthy glow. Revenue within consumer-facing events businesses like Apartment Therapy’s Small/Cool franchise, remained flat year over year, even with the timeline pushed back.

So why, despite all of the bellyaching around advertising budgets this year, did professional/B2B publisher events turn out so well? It seems there is no one-size-fits-all strategy that was used amongst the publishers to yield such a positive outcome, though adapting a page from publishers’ virtual events playbooks does seem to be a common and successful tactic.

Ad position: web_incontent_pos2

Less is — or isn’t — more

Axios chose to increase the number of events in their playbook to create more inventory to sell.

The seven-year-old company will have increased its event volume by about 20% from 2022 to 2023 when all is said and done, according to Jonathan Otto, Axios’s gm of global, national and local events. And that’s largely due to what his title puts out — focusing on franchisable IP events for its national and local brands as well as showing up with events that run adjacent to global industry events, like the Cannes Lions Festival. So far, Axios has hosted a total of 85 events this year and will reach about 100 by the end of the fourth quarter, he added.

But Bloomberg is not following that same rule.

Webber said that the goal going into 2023 was to winnow down the various iterations of its large events franchises and combine them into larger, more holistic summits that would bring in a wider variety of attendees, broaden the editorial tracks and ultimately scale up the sponsorship opportunities within these more robust events.

Take the Bloomberg Invest Summit in June, which took place in New York City. Rather than hosting a Wealth Summit and a Crypto Summit as tangential standalone events, those have been folded into the Invest Summit.

“We were very bullish going into 2023 because we wanted to anchor around a new strategy, which is a strategic decision actually to reduce the number of events that we do … in order to have each event have its own impact and scale,” said Webber.

Convening the “right” audience

While volume doesn’t matter for Bloomberg, size doesn’t matter for Semafor when it comes to attendance — so long as the people in the room are from the right companies, organizations and positions of power.

“Smaller, more intimate events are more valuable than massive gatherings. And I think it’s important to be able to pull this stuff off globally,” Oppenheim said, which is easier to do with a more nimble headcount to manage. She added that Semafor’s events have had headcounts as intimate as 35 people as well as events with attendance of a few hundred.

Adding scale after the event

Digital reach was a major strength from virtual events that’s being carried out in a slightly new capacity now.

Rather than limiting the on-stage sponsor activations or experiential creatives to the in-person audience (which as previously mentioned could be pretty small), Axios, Bloomberg and Semafor all discussed how they were ripping audio and video assets to create post-event campaigns that can run on the publishers’ other products.

For example, Webber said that audio from on-stage interviews with sponsors’ leaders has been used in podcast ads while video assets from a Google Chrome arcade activation at a tech event was converted into commercials that run on Bloomberg TV for the sponsor.

Axios’s “view from the top” segments, which puts an advertiser’s c-suite exec on-stage to accomplish some of the thought leadership goals of event sponsorships are also used outside the realm of the event for further digital amplification, Otto added.

What we’ve heard

“Twitter is an example of a platform that has been seen as the town hall for the internet for a really long time, and has fueled a lot of amazing conversations. It’s also, however, a platform that over the years has struggled with speech that not everyone deems acceptable … So if you’re a brand with 500,000, or a million followers on Twitter/X, and you decide not to use the platform anymore, that audience is just gone … In a fediverse platform, the audience no longer belongs to the individual platforms, at least, that’s the philosophy.”

— Martin Pagh Ludvigsen, director of creative technology and AI at Goodby, Silverstein and Partners, on the latest episode of the Digiday Podcast explaining what the fediverse is and why brands might start experimenting there soon.

Venture capital funding to publishers tanks in Q3

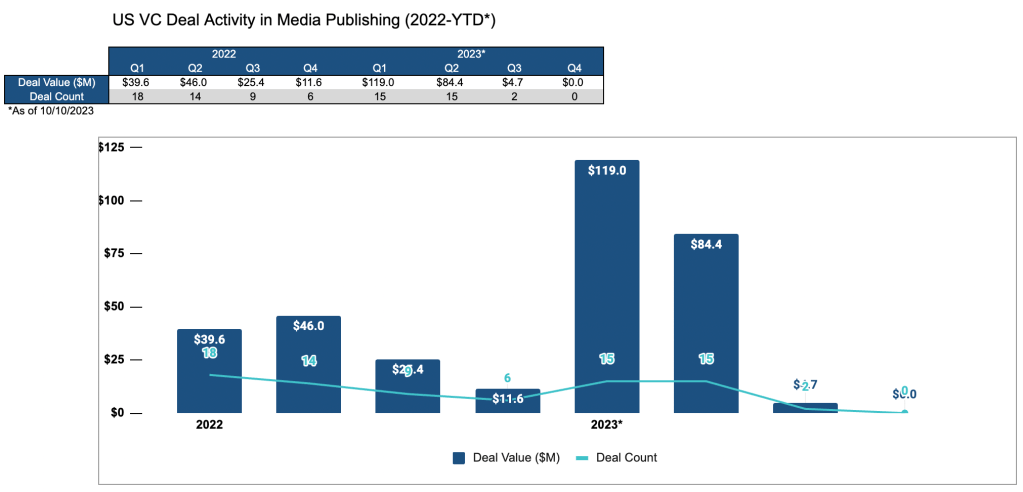

There was a significant decline in U.S. venture capital funding activity in the media publishing sector in Q3 2023 compared to the previous quarter, according to capital market research firm Pitchbook.

Pitchbook data provided to Digiday shows the total VC deal activity — i.e. the amount of money invested by VCs — in the media publishing sector in Q3 2023 was down to $4.7 million with two deals, compared to $84.4 million with 15 deals in Q2 2023. Q3 2022 deal activity totaled $25.4 million with nine deals.

The broader U.S. VC market continued to show a decline in total deal activity during Q3 after an overall slowdown in 2023 compared to last year, said Kyle Stanford, a venture capital analyst at PitchBook. The amount of money invested by VCs in Q3 2023 was $32.7 billion, compared to $46.4 billion in Q3 2022.

“Media is a much smaller market and more difficult market with a lot of changes over the past few years so it hasn’t been this high-flying VC market, so the decline there is not something to be unexpected in this very, very slow market,” Stanford said. “No industry has flown under the radar here and been able to kind of escape the problems.”

While Q3 is historically a slower quarter in the year, the confluence of geopolitical issues like the recent conflict in Israel and uncertain macroeconomic conditions do not bode well for the VC market going forward, Stanford said.

“We don’t expect any real immediate change in any direction,” Stanford said. If valuations in the public market continue to stay flat, “We expect everything to continue to stay slow,” he said.

A media executive and investor who asked to remain anonymous echoed this sentiment.

“I still think we’re just at the beginning of a very bad macroeconomic situation. We’re not at the end of it.”

The media exec believes there’s more opportunity for media investors to spread their money around as more publishers, platforms and content creators pop up, making it more challenging for individual media companies to raise funding, they said.

“My belief is even if the pie does manage to get even a little larger overall, it is sliced into so many more and smaller pieces than ever before,” they said. — Sara Guaglione

Numbers to know

6: The number of months since NPR left X (née Twitter) after being incorrectly labeled as “U.S. state-affiliated media,” and according to the non-profit media organization, the move off of the platforms has had a “marginal” impact on web traffic.

150: The number of staffers on The New York Times’ opinion desk, triple the amount of employees it had in 2017 when Kathleen Kingsbury joined as deputy editorial page editor.

240: The number of jobs The Washington Post will be cutting from its staff. The company hopes to accomplish this reduction via voluntary buyouts.

What we’ve covered

WTF is traffic shaping?

- Traffic shaping has been used within the ad tech industry for a while, particularly by SSPs DSPs filtering out available programmatic ad inventory that isn’t quite up to snuff.

- Recently, however, a few publishers have started taking traffic shaping into their own hands with the ultimate goal of only putting their most premium ad inventory up for sale.

Watch a video detailing the ins and outs of how publishers are using traffic shaping here.

Publishers react to X update removing headlines from posts:

- As of last week, the social media platform formerly known as Twitter no longer automatically features headlines in posts containing links.

- “What a bozo move,” said one publisher.

Read more publisher reactions and strategies for dealing with this change here.

Campbell Brown’s exit from Meta elicits no more than a whimper from publishers facing a deteriorating relationship with Facebook:

- Five years ago, the news of Facebook’s most prominent publisher liaison leaving the company would have sent a seismic shock to the digital media ecosystem.

- But as a sign of the times, Campbell Brown’s announcement that she is leaving her post as Meta’s head of global media partnerships this fall elicited a metaphorical shrug from publishers.

See why publishers were nonplussed about the announcement here.

What we’re reading

Texas Monthly’s true crime coverage is its entrance into Hollywood:

To date, Texas Monthly has sold 50 film and TV projects to studios, streamers and entertainment companies in Hollywood, with over half of the IP coming from its true crime journalism, Insider reported. Now, the publication’s president Scott Brown is hoping Texas Monthly can translate that business into 10% of its total revenue in 2024.

Under its new top editor, The Wall Street Journal has gone through a year of upheaval:

Emma Tucker took over as the editor-in-chief of The Wall Street Journal in February and immediately undid many of the “traditions” at the paper. In the subsequent months, more than 15 longstanding editors and writers left, or were pushed out, and in a staff meeting last month, Tucker revealed more changes were imminent, according to a report by The New York Times.

CNN’s new CEO tells staff to step it up on digital:

On his first official day as chief executive, Mark Thompson told the CNN staff that traditional TV can no longer sustain the news media network and that more effort needs to be put into digital, The Wall Street Journal reported.

More in Media

What publishers are wishing for this holiday season: End AI scraping and determine AI-powered audience value

Publishers want a fair, structured, regulated AI environment and they also want to define what the next decade of audience metrics looks like.

Digiday+ Research Subscription Index 2025: Subscription strategies from Bloomberg, The New York Times, Vox and others

Digiday’s third annual Subscription Index examines and measures publishers’ subscription strategies to identify common approaches and key tactics among Bloomberg, The New York Times, Vox and others.

From lawsuits to lobbying: How publishers are fighting AI

We may be closing out 2025, but publishers aren’t retreating from the battle of AI search — some are escalating it, and they expect the fight to stretch deep into 2026.

Ad position: web_bfu