Save 50% on a 3-month Digiday+ membership. Ends Dec 5.

In programmatic, buyers sometimes don’t know what type of auction they’re bidding in

Programmatic ad buying theoretically brings full transparency to ad buys, but the nature of the system often shrouds the process. Take the seemingly simple issue of what kind of auction it is.

Programmatic ad buying has long been operated as second-price auctions, meaning buyers will pay a penny more than the next lowest bid. That means if you bid, say, a $40 CPM on a valuable user, and the next bid is $12, you’d only pay $12.01. In a first-price auction, in which the highest bid wins the auction, you’d pay the $40. Needless to say, bidding strategies are different based on the auction.

The current complication arises from an influx of first-price auctions in programmatic. Many ad buyers are left in the dark when it comes to the setup of the auctions they’re bidding in. Since buyers can only audit the vendors they work directly with on the demand side, they have no way to verify if other programmatic platforms in the ad supply chain are altering auction structures to covertly eke out more revenue. Translation: A buyer might think they’re buying based on second price but really be in a first-price auction. That can get expensive, since the bid strategies are far different.

“Vendors tell us they are on a second-price model, and it is part of their pitch when they meet with you,” said Yeliza Centeio, associate media director at ad agency CTP Boston. “But post-campaign, you don’t get any data to prove it, and it is extremely frustrating. It is one of those situations where it is our suspicion against their word.”

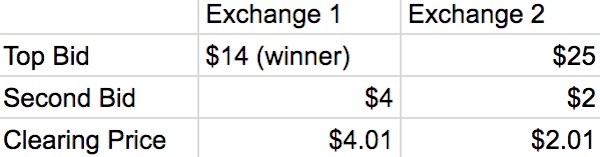

The shift to first-price auction is not necessarily a bait-and-switch game. There are good reasons to have first-price auctions. For instance, in header bidding, the highest bidder doesn’t always win if the auction is second-price. In the example below, the $14 bidder, not the $25 bidder, won because the second-highest bid in the first exchange was higher than the second-highest bid in the second exchange.

To clear up these snafus, exchanges and SSPs adapted to header bidding by offering products that had first-price auctions, said Michael Santee, programmatic media director at ad agency Cramer-Krasselt. This makes more sense for all sides.

Ad position: web_incontent_pos1

But the introduction of a new auction dynamic has also created confusion because buyers aren’t sure how the auction they are bidding on is set up since they usually have no visibility into its price structure. Without clarity on pricing, buyers don’t know how to strategize their bidding. If it is first-price, buyers should only bid what they are willing to pay. If it is second-price, they can bid high to win an impression since it should clear at a lower rate.

“With this hybrid situation, it is hard to understand what levers we should pull and how high we should bid,” said Liane Nadeau, associate director of programmatic media at DigitasLBi.

A further wrinkle: Some supply-side platforms offer both first-price and second-price auctions to appease the preferences of their publisher clients. The publishers themselves can flip-flop on the price structure they use.

That’s where skullduggery enters stage left. For example, a DSP will tell a buyer that the exchange it is buying from uses first-price. The buyer is now under the impression that the bidding price will be the same as the price that wins the impression. In reality, the exchange uses second-price. The money in the middle — the difference between the cost of the impression and the buyer’s bid — gets split between the programmatic platforms involved in the transaction. Hello, extra margin.

“One or two pennies per impression doesn’t sound like much, but billions of impressions add up,” said a DSP exec requesting anonymity.

Ad position: web_incontent_pos2

Ad buyers only get visibility into one step in the ad supply chain, which means these transactions aren’t traceable for buyers. If an ad buyer is working with a DSP, which is working with an exchange, which is working with an SSP, the buyer can only look into the bidding the DSP that it directly works with does, said Justin Kennedy, co-founder of ad tech firm Sonobi, which started as an SSP but now operates on the buy side, too. Tracing these transactions becomes even more complicated if the SSPs are reselling the inventory.

This is problematic for buyers because if the SSP is the player responsible for changing the auction structure, the buyer has no way to hold the SSP accountable. There is no legal obligation for SSPs or exchanges to be auditable to ad buyers, said a DSP exec requesting anonymity. Theoretically, the DSP could press back on the exchange and the exchange could press back on the SSP, but unless a large-spending client threatens to end its relationship with the DSP, the DSP has little incentive to get tough with the other platforms in the supply chain.

“It’s not that the platforms are evil and nefarious,” the exec said. “They are getting crushed and being forced to take lower margins, so they are looking under their seat cushions for money, and this is one way to make some margin. Most brand clients don’t even care; they just care about their agency taking money. They don’t care about how someone three parties removed is taking money.”

The Interactive Advertising Bureau’s OpenRTB protocol already has a variable called “auction type” that indicates whether an impression is being sold via first-price or second-price. But the IAB can’t force exchanges to adopt the variable, and many programmatic platforms eschew it. And most buyers aren’t even forcing the issue. One DSP exec said none of his clients have ever demanded visibility into auction pricing.

As Nadeau put it: “So many people don’t know this is happening, so they don’t know to ask for this granular level of transparency.”

More in Marketing

Ulta, Best Buy and Adidas dominate AI holiday shopping mentions

The brands that are seeing the biggest boost from this shift in consumer behavior are some of the biggest retailers.

U.K. retailer Boots leads brand efforts to invest in ad creative’s data layer

For media dollars to make an impact, brands need ad creative that actually hits. More CMOs are investing in pre- and post-flight measurement.

Ad position: web_bfu