Save 50% on a 3-month Digiday+ membership. Ends Dec 5.

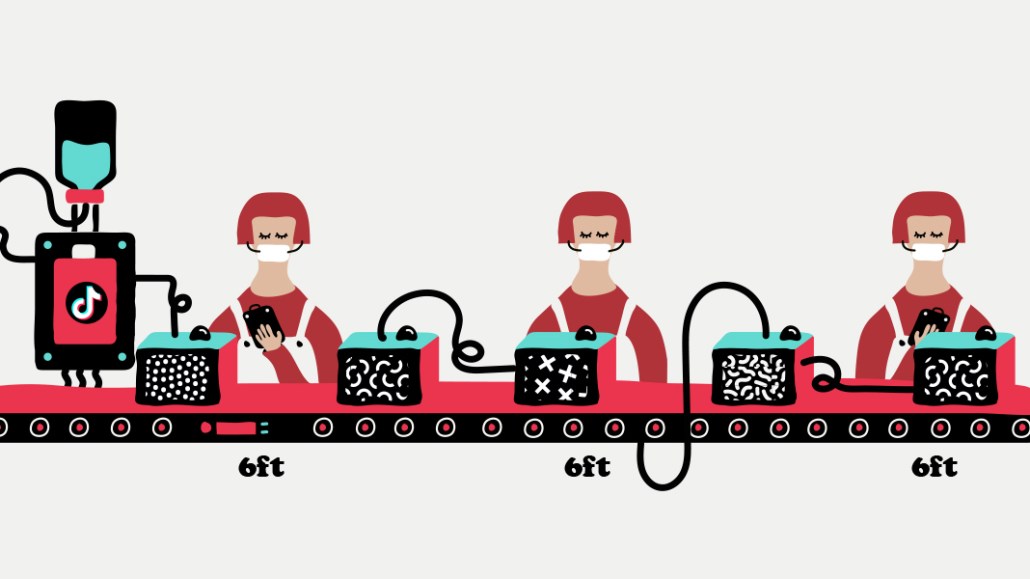

TikTok’s self-service platform launch is perfectly timed to kick Facebook while it’s down

TikTok is coming for Facebook.

This week its opened its self-serve advertising platform to all advertisers globally, arriving amid a period of escalating tension between Facebook and Madison Avenue. TikTok has also extended an olive branch to new advertisers: Free ad credits, designed to convince small- to medium-sized businesses — Facebook’s core advertising constituents — to try TikTok out for the first time.

Experts suggest the current market conditions set TikTok up as a worthy challenger to Facebook’s ad dominance, fairly early into TikTok’s existence.

“I can’t emphasize how aggressively [TikTok] is trying to take share at the moment,” said Paul Kasamias, managing partner of performance at media agency Starcom. “They’re going after Facebook, they aren’t going after Snapchat … that’s the mantra from the business. They are not just here to take a little share: They believe they can be bigger than Facebook in the coming years, and quickly.”

TikTok continues to follow the playbook other social platforms have charted before it, where launching a self-serve platform unlocks a sizable spigot of revenue growth from performance advertisers. Experts have noted TikTok’s product rollout and third-party measurement and ad verification partnerships announcements have amassed far quicker than its competitors. TikTok has been beta testing the platform since last fall and had been talking to agencies for at least two months about its imminent launch, according to two agency staffers. A TikTok spokesperson said the launch had always been planned for the summer and that it has not been expedited.

If past history is anything to go by, the first three months will be a key “window of opportunity” for TikTok to bring new advertisers on board given the supply-demand economics of ad auction marketplaces, said Kasamias. Anthony McGuire, a former Facebook employee who now works as a technology consultant and startup founder concurred. Facebook’s strategy to win around reluctant first-time advertisers was to set them up on a three month test, he said.

Ad rates on Snapchat were around 30% lower than comparable ads on Facebook in the first three months after the former company launched its self-serve ad manager in 2017 and then started calibrating upwards as more advertisers began to use the service, Kasamias recalled. Self-serve cost-per-view rates on TikTok are also currently tracking at around 30% lower than those on Facebook, Kasamias said.

Ad position: web_incontent_pos1

Facebook’s pain is TikTok’s gain

As many larger marketers hit pause on spending in the earlier throes of the coronavirus crisis, CPMs on Facebook plummeted and many small businesses and direct-to-consumer advertisers jumped on the opportunity — especially as many were forced to ramp up their e-commerce operations. Not only that, but many DTC brands reported higher than usual conversion rates, with Facebook and Instagram becoming significant performance marketing channels.

Facebook CPMs soon bounced back in May. Then in June, the “Stop Hate For Profit” advertiser boycott gained momentum and hundreds of brands have committed to pausing spend on Facebook for the month of July and in some cases longer. (Some large advertisers have also pledged to remove their advertising from other social platforms.) Yet, many DTC companies were in a bind about participating. While they supported the spirit of the movement, many digitally native brands are reliant on Facebook and Instagram for a majority of their sales, as Modern Retail reported. Small businesses are understood to make up the lion’s share of Facebook’s advertiser base. TikTok’s alternative has arrived slapbang in the middle of the July boycott — and in the same week Facebook flunked an independent civil-rights audit.

“A lot of the SMBs I have spoken to and VCs really do feel like they are over-reliant on Facebook [and there is an opportunity] for diversifying the performance budget options,” said Stefan Bardega, a marketing consultant to small- to medium-sized businesses and former EMEA president of iProspect. As for TikTok’s launch, he added, “If you want to get a slice of the Q4 retail pie you’ve got to start now.”

The new self-serve platform launched as usage of TikTok has soared. TikTok has generated close to 2.3 billion downloads worldwide across the App Store and Google Play to date, according to mobile app measurement firm Sensor Tower. This figure also includes the Chinese version of the app, Douyin. Around 19% of lifetime downloads to date — approximately 439 million installs — took place between March 1 and July 8 as the coronavirus crisis swept across the world. The average time spent per month on the app per U.S. user rose 93% to 855.6 minutes between October last year and May this year, according to Comscore.

Ad position: web_incontent_pos2

SMBs may have only heard about TikTok six months ago and not considered using it as a marketing platform, but that soon changed as the coronavirus crisis escalated, said McGuire. Some SMBs have also benefited from the platform’s early organic reach, he added.

Chiropractor “@dr.cracks,” who remixed the popular Savage dance challenge to demonstrate stretches to relieve lower back pain, for example, has racked up more than 2.3 million likes for that TikTok alone. That said, it’s unclear how easy it will be for SMBs to gain virality as the platform matures.

Credit where credit’s due

TikTok said this week it is committing $100 million of advertising credits at for small-to-medium businesses in 18 countries, including the U.S. and U.K., to be used this year as part of a “back-to-business” program to help companies affected by the coronavirus crisis. That includes a one-time free credit of $300 and any additional spending up to $2,000 matched with another credit. For the $300 credit, there is a daily cap for each region, though eligible businesses can opt to claim it the following day. The credits will be awarded at the same time to eligible businesses at the same time, after a verification process, per a spokesperson.

Free ad coupons for new customers are not unusual in the online ad space, but as the coronavirus crisis began to take hold several large platforms offered ad credits as a way of support.

Facebook in March pledged $100 million in cash grants and advertising credits to small businesses in more than 30 countries to help them weather the storm. However, at the time of writing (July 9) for 94% of the 36 listed countries listed on the grants program page Facebook says it is still working through eligibility details for those regions. The website says it is no longer accepting applications for companies in the U.S. and Canada.

“Our small business community has been clear that financial support is what they need and we are working to support them,” said a Facebook spokesperson. “Our $100 million global grants program is halfway rolled out, over 10,000 small businesses from multiple countries will have received a grant by the end of the month and we are on track to rollout the full program by the end of the summer.”

Google announced a $340 million ad credit program for small businesses in March. Credits, which varied depending on past spend, were applied automatically to accounts in July, a spokesperson confirmed.

TikTok’s business challenges

Facebook and TikTok are not like-for-like platforms. TikTok’s targeting and measurement options are still nascent, its audience skews younger and uncertainties linger around the quality of its data and brand safety options, experts said. TikTok’s full-screen video ad format that often leverage the “challenges” and dance trends popularized by its users tend to require more heavy lifting in the creative department than an average, static Facebook news feed ad. Yet experts also credited the slick user experience of the new self-serve ad interface — which resembles other ad managers — and the potential to reach audiences in a different way.

“The biggest opportunity is probably the audience: TikTok say 40% of those on TikTok aren’t on Facebook,” said Kat Harding, social director at Havas marketing agency Cake. “It’s unsaturated and you can get a lot of bang for your buck.”

For advertisers not looking to target a younger demographic, YouTube is likely to be a more suitable alternative to Facebook and Instagram, given its audience structure and available formats, said Werner Iucksch, global digital strategy director at We Are Social Singapore

TikTok faces major challenges aside from looking to boost its appeal to advertisers. Several governments around the world have voiced their concern about TikTok’s ownership, the Chinese firm ByteDance, and whether the company might share its user data with the Chinese government. India, for one, banned TikTok — along with dozens of other Chinese apps—late last month. Earlier this week U.S. Secretary of State Mike Pompeo said in an interview that the U.S. is “looking at” banning TikTok and other Chinese social media apps.

TikTok has maintained that it has never shared user data with the Chinese government and wouldn’t do so even if it was asked. The company recently hired the high-profile former Disney executive Kevin Mayer as its chief executive officer, who is based in the U.S. The Wall Street Journal reported earlier this week that ByteDance is considering changing TikTok’s corporate structure to further distance the app from its Chinese parent.

TikTok’s bid to topple Facebook won’t happen overnight. Bytedance recorded $5.64 billion in revenue in the January to March quarter, Reuters reported last month, citing two people with knowledge of the matter. Facebook reported $17.7 billion in revenue in the March quarter.

More in Media

What publishers are wishing for this holiday season: End AI scraping and determine AI-powered audience value

Publishers want a fair, structured, regulated AI environment and they also want to define what the next decade of audience metrics looks like.

Digiday+ Research Subscription Index 2025: Subscription strategies from Bloomberg, The New York Times, Vox and others

Digiday’s third annual Subscription Index examines and measures publishers’ subscription strategies to identify common approaches and key tactics among Bloomberg, The New York Times, Vox and others.

From lawsuits to lobbying: How publishers are fighting AI

We may be closing out 2025, but publishers aren’t retreating from the battle of AI search — some are escalating it, and they expect the fight to stretch deep into 2026.

Ad position: web_bfu