Save 50% on a 3-month Digiday+ membership. Ends Dec 5.

This research is based on unique data collected from our proprietary audience of publisher, agency, brand and tech insiders. It’s available to Digiday+ members. More from the series →

At the Digiday Video Anywhere Summit last November, we sat down with 76 industry leaders from major U.S. media companies to discuss the growing importance of over-the-top video. Check out our research on the future of video monetization on Facebook here. Learn more about our upcoming events here.

Top findings:

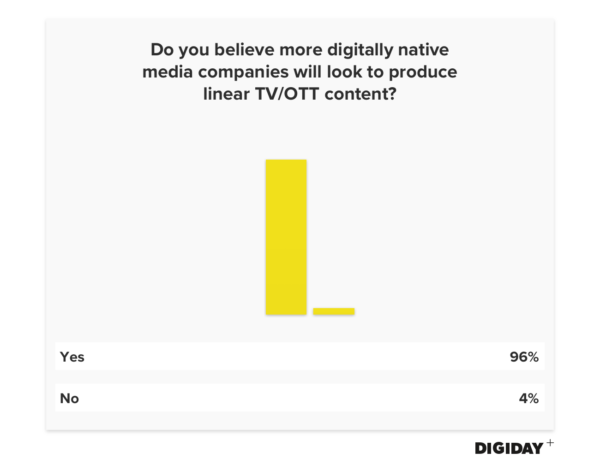

- Ninety-six percent of respondents expect more digital media companies to produce either TV or OTT content.

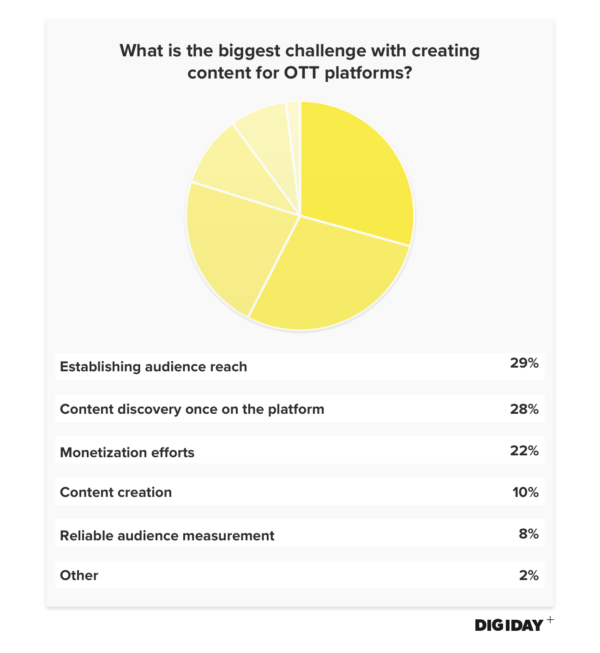

- Content discoverability and audience reach were the two most-cited challenges associated with creating content for OTT platforms.

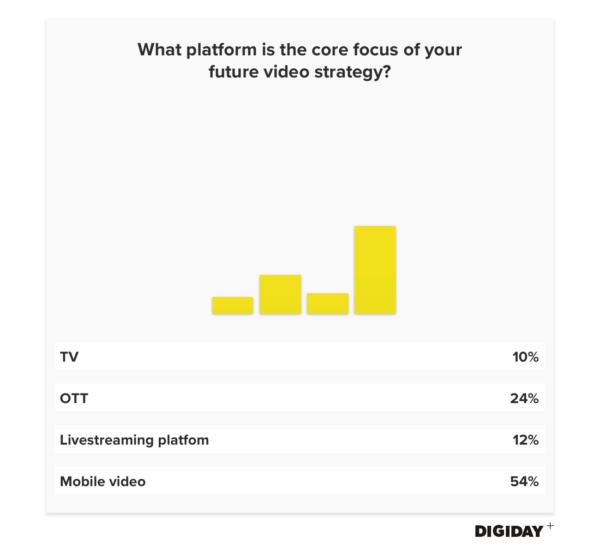

- Fifty-four percent of respondents said mobile video was the core focus of their future video strategy.

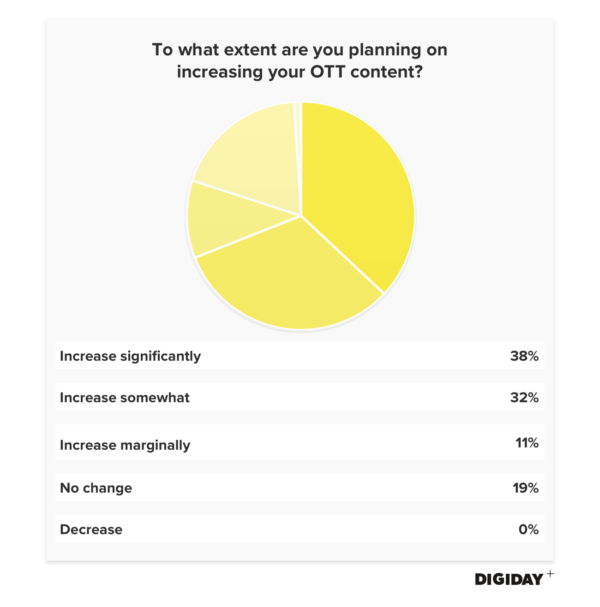

- Eighty-one percent said they are looking to increase OTT content.

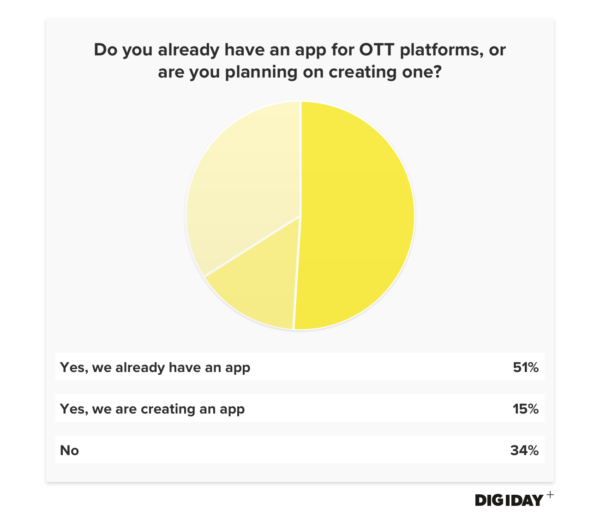

- Sixty-four percent either already have an app or are creating one for their OTT content.

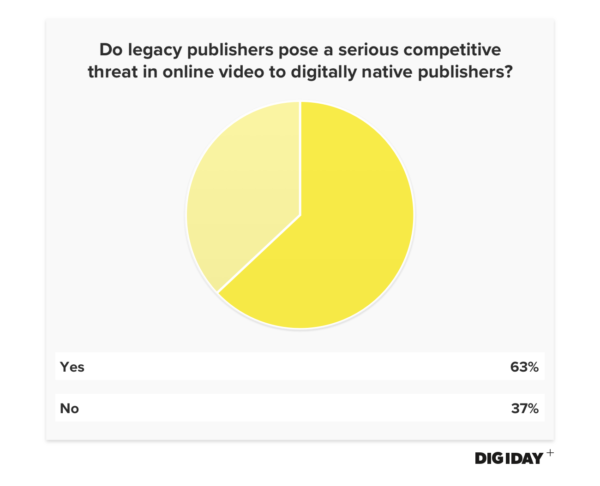

- Nearly two-thirds believe legacy publishers pose a threat to digitally native publishers in online video.

Most digitally native companies are expected to produce linear TV or OTT content

In 2017 publishers were forced to recognize their businesses could not be supported by digital ads alone. Being born and maturing solely online no longer guarantees that a company will be able to navigate complex and changing digital advertising markets.

In an effort to diversify their offerings and revenue streams, publishers such as NowThis, Cheddar, Ozy, Vox and BuzzFeed are producing long-form content for linear TV and OTT platforms. This trend is expected to continue, with almost all respondents saying they believe linear TV or OTT content will be a key strategy for digitally native publishers.

Cheddar, which is already on OTT platforms Sling TV, Amazon and Pluto TV, expanded into linear TV markets with Tegna to build its audience via a less competitive market. Ozy Media worked with PBS to develop shows around politics and current events. But don’t expect all digital companies to succeed at these endeavors, said Carlos Watson, CEO of Ozy. “A lot of companies have built significant audiences through cat videos on Facebook,” he said. “It’s not easy for those companies to go from cat videos to producing high-quality, long-form content. It’s much tougher than it looks.”

Whether media companies are doing it for the money or the audiences, one thing is clear: They’re chasing potential viewers where they spend most of their time, and linear TV is winning the attention war. Americans spend nearly four hours per day watching traditional TV, compared to just one and a half hours watching digital video, according to eMarketer.

Audience reach and content discovery are top challenges with OTT content

When creating OTT content, the three biggest challenges media companies face are building new and loyal audiences, discoverability of content and monetization, according to Digiday’s survey results. With over 200 OTT services available to U.S. consumers, building committed audiences is hard. Simply getting content on a service doesn’t guarantee mass exposure. Brett Sappington, senior director of research at Parks Associates, estimates that more than 70 of the OTT services that Parks Associates tracks have fewer than 10,000 subscribers.

Ad position: web_incontent_pos1

Consumers are rarely loyal to one service. Users splitting their time between multiple services impedes audience development efforts. Research from Second Measure found that among six large streaming services, Netflix was the only one with a majority of members who aren’t subscribed to other services. These findings could imply building audiences is easier than first thought. However, the opposite is true for media companies providing content to those services. If subscribers jump between multiple services, it decreases the potential time spent viewing a given media company’s content, while increasing competition for users’ attention.

Even backing from a major television provider or telecommunications company doesn’t guarantee success. Dish Network’s Sling TV boasts more than 2 million subscribers, but its competitors haven’t fared as well. AT&T’s DirectTV Now and Sony’s PlayStation Vue account for just 1.1 million subscribers combined. Facing low subscriber numbers, Comcast pulled back on its OTT play Watchable. Verizon’s struggling Go90 is in a holding pattern as the company plots other OTT offerings. Of the 200 OTT platforms available, 30 percent have a major corporate sponsor, according to Sappington.

Part of the challenge media companies face with scaling OTT audiences is getting viewers to find their content. Netflix users in the U.S. can choose from over 5,500 different TV shows and movies, while Amazon Prime offers nearly 12,800 options. Even a niche service like AMC’s horror-themed Shudder has 500-plus selections. With all those choices, it’s no wonder that research from Reelgood found that Netflix users spend 17.8 minutes reviewing possible options before making a selection, nearly twice as long as TV viewers spend.

As Hulu showed, building a monthly subscription service doesn’t necessarily solve monetization issues. Most OTT companies are following Hulu’s lead, though. Eighty-seven percent of OTT companies offer some kind of ad-free subscription product to consumers, according to a Parks Associates study. But Sappington doesn’t believe ad-supported streaming and OTT products will disappear. “[We] believe that ad-based services will play an increasingly important role with consumers and with the industry,” he said. “While consumers don’t like ads, they do like access to free content.”

Ad position: web_incontent_pos2

Companies with OTT products have good cause to be wary of including advertisements in their content. In an IBM survey of OTT users, 72 percent of respondents felt that any ads worsened their viewing experience. As companies look beyond content investments to gain an edge in such a crowded landscape, marginal user-experience enhancements such as shortening or ditching ads altogether could make a difference.

Most media companies see mobile video as the future

As subscriber counts swell and companies pump billions of dollars into funding content for new shows, it’s easy to think OTT will soon consume all media. However, media companies’ strategies reflect a different picture. Fifty-six percent said their core focus was developing content for mobile video instead of OTT. Despite the binge-watching of “Stranger Things” and “Game of Thrones,” time spent watching mobile video still outpaces OTT watch time for U.S. consumers. Of the total 77 minutes a day people spent with digital video, mobile video accounted for 33 of those, roughly 175 percent longer than people spent watching OTT content, according to eMarketer.

Users spend the bulk of their digital viewing time with mobile video, but that’s not the only reason it’s more attractive than OTT. Compared to mobile video and other viewing options, OTT falls behind in cost-effectiveness, according to Russ Ellis, a former vp at Trusted Media Brands, speaking at MediaPost’s Publishing Insider Summit.

Expect the OTT wave to endure

The pivot to video might have come and gone like a fad, but it appears that OTT viewing has staying power. Compared to how much publishers are expected to increase their digital video production, OTT content creation could take off at a much faster rate. Despite the challenges associated with OTT, no publishers have plans to cut back production. Four out of five respondents said they plan to increase their output of OTT content, nearly half of whom indicated that production would increase significantly. Realigned consumer preferences are driving this growth. “OTT is now just another mainstream viewing option, together with cable and satellite, and it is increasingly the first option,” said Peter Csathy, founder of media advisory firm Creatv Media.

OTT app creation continues

Many OTT apps exist. Roku alone had 5,000 channels for U.S. viewers in July 2017, up from 4,500 at the beginning of the year. Over half of the companies we surveyed said they already had an OTT app, while 15 percent said they are producing or have plans to produce one.

While apps offer an opportunity for media companies to consolidate their content into one searchable location, OTT apps can be difficult to build and maintain. About one-third of companies lack an app for OTT viewing, potentially due to technical hurdles or because they don’t produce enough content to necessitate one.

Legacy publishers make strides in video

While legacy publishers suffered the decline of print, digital-first and digital-only media companies established reputations for being innovative and tech-friendly. Legacy publishers have since embraced new media formats and technologies, worrying digital media companies. Motor Trend, founded as a magazine in 1949, launched its own streaming service for Roku and Apple TV, for example. Meanwhile, Time Inc.’s PeopleTV streaming service has already been downloaded more than 2 million times.

Roughly two-thirds of respondents believe legacy publishers can challenge digitally native media companies in online video. Unlike digital media startups beholden to venture capitalists to provide immediate results, large legacy publishers have the financial resources to build sophisticated products and the luxury to be patient while those products develop.

Watson believes digitally native companies should view legacy publishers and TV producers as strategic partners rather than a threat. To date, Ozy has strengthened its partnership with PBS, as other digital-first companies make similar moves. Vox-owned Recode recently announced a partnership with MSNBC to co-produce a tech-themed news show. Vogue and Vice are joining forces to produce written and video content in an effort win blue-chip advertising dollars. Claudia Cahill, Omnicom Media Group’s chief creative officer, thinks these partnerships between digital-first companies and legacy publishers will soon become the norm.

Watson believes digitally native companies should view legacy publishers and TV producers as strategic partners rather than a threat. To date, Ozy has strengthened its partnership with PBS, as other digital-first companies make similar moves. Vox-owned Recode recently announced a partnership with MSNBC to co-produce a tech-themed news show. Vogue and Vice are joining forces to produce written and video content in an effort win blue-chip advertising dollars. Claudia Cahill, Omnicom Media Group’s chief creative officer, thinks these partnerships between digital-first companies and legacy publishers will soon become the norm.

More in Media

What publishers are wishing for this holiday season: End AI scraping and determine AI-powered audience value

Publishers want a fair, structured, regulated AI environment and they also want to define what the next decade of audience metrics looks like.

Digiday+ Research Subscription Index 2025: Subscription strategies from Bloomberg, The New York Times, Vox and others

Digiday’s third annual Subscription Index examines and measures publishers’ subscription strategies to identify common approaches and key tactics among Bloomberg, The New York Times, Vox and others.

From lawsuits to lobbying: How publishers are fighting AI

We may be closing out 2025, but publishers aren’t retreating from the battle of AI search — some are escalating it, and they expect the fight to stretch deep into 2026.

Ad position: web_bfu