Save 50% on a 3-month Digiday+ membership. Ends Dec 5.

As Moda Operandi’s traffic from social was increasing at a clip of 140 percent year over year, the company turned to Instagram to figure out how it could turn that interest into actual purchases.

The retailer, which is a platform for pre-ordering items from designers’ runway collections online, as well as an in-season e-commerce boutique, had been using Curalate’s Like2Buy platform in order to make it easier to shop Instagram, the social platform that drives the most revenue for Moda Operandi. When Curalate launched an integration with Amazon Pay that put a one-step checkout button directly on the Like2Buy platform, cutting out a jump to the retailer’s product page from the purchasing process, Moda Operandi was the first brand to try it.

“With the nature of high fashion, Instagram is a big driver of traffic,” said Keiron McCammon, Moda Operandi’s chief technology officer. “Getting people to directly purchase on these social platforms is a high priority for us in pushing the boundaries of luxury and how it’s sold online.”

With the new integration, users on Moda Operandi’s Instagram feed, which has close to 1 million followers, can shop and pre-order newly launched collections through the Like2Buy link, which lives in Moda Operandi’s account bio. Amazon Pay lets Like2Buy incorporate a selection process, like size and color, and shoppers can populate their Amazon account information to check out by hitting just one button. Their shipping and billing information will be filled in automatically, and there’ll have no need to visit the retailer’s product page to finish the purchase. The order will then be managed through the retailer’s site. While Moda Operandi is the first brand to enable the integration, any brand or retailer that has Amazon Pay incorporated at checkout can tie it to Like2Buy to offer the same experience.

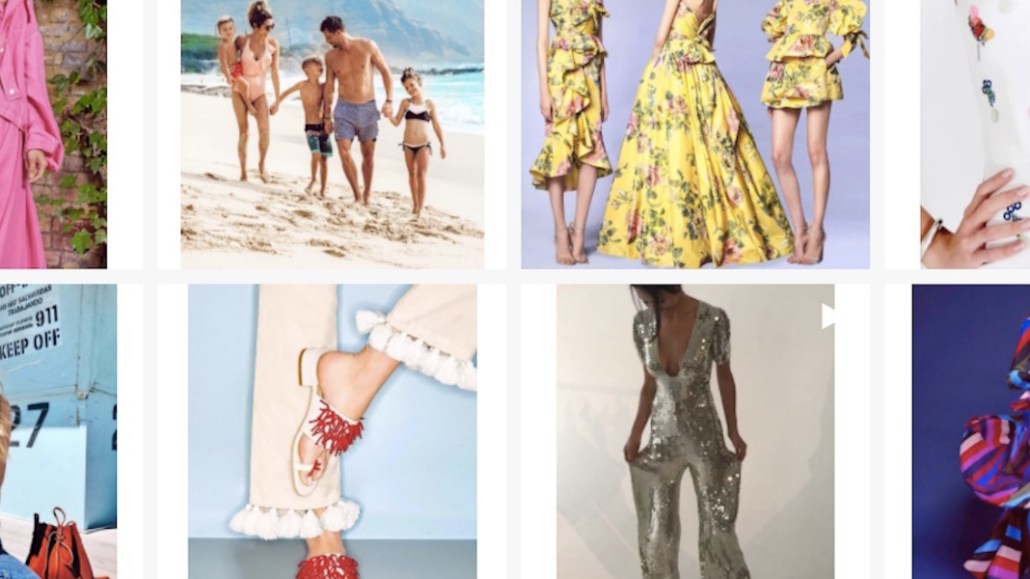

In-app purchases on Like2Buy

According to Curalate chief technology officer Nick Shiftan, the Amazon Pay partnership came together as the company was searching for ways to simplify the Like2Buy purchase process. It’s always been a flawed system, requiring several steps to purchase, often losing customers along the way. Amazon’s reach and membership base — which Shiftan said had a large percentage of overlap with Like2Buy’s shoppers — was seen as a boost for the company.

It’s currently competing with Instagram’s own in-app integration, which lets brands tag products in posts with prices. Clicking on those takes shoppers to a middle-ground product carousel with more details. To make the purchase, there’s an additional jump to the retailer product page. The launch of Instagram’s shopping tags was a blow to third-party platforms that made a business around Instagram’s lack of purchase functionality, like Like2Buy. But with Amazon Pay, Like2Buy is making its path to purchase shorter than Instagram’s.

Ad position: web_incontent_pos1

“Like2Buy [has always] turned that Instagram inspiration into a potential purchase, but it’s always been a shame that the best we could do is link to the outside product page,” said Shiftan. “This [shortens] the distance between that moment of discovery and checkout.”

McCammon said Amazon’s broad reach of members was appealing to Moda Operandi, too, considering customers making expensive luxury purchases online like to make payments through a trusted and familiar source. (For the retailer, average order value is $1,500, and the most expensive item purchased via mobile was $80,000.) Through the few weeks of testing with the Like2Buy integration, Moda Operandi saw a “significant uptick” in conversions for first-time customers.

“They know a lot about their customers, and it’s a large reach for us,” said McCammon. “This is a way to leverage the Amazon brand to overcome people’s concerns with landing on the Moda site and maybe not knowing us. This is a way to feel more comfortable with the transaction.”

It’s also a way for Moda to feel more comfortable working with Amazon. While it’s a been a technology partner since the beginning of last year — Amazon Pay also powered Moda Operandi’s pop-up stores — Amazon isn’t a retail partner of the company’s. According to McCammon, while Amazon is developing its own fashion business, Moda’s business will stay on its own site.

“We’re about the feeling of luxury and trust that comes with representing a designer product, and that’s very hard for us to achieve by simply putting it in a data feed that’s being pumped into the Amazon marketplace,” he said. “You’re not going to get the luxury experience that way, and the high-end, pre-order business that we have is very hard to do in any other place.”

More in Marketing

Ulta, Best Buy and Adidas dominate AI holiday shopping mentions

The brands that are seeing the biggest boost from this shift in consumer behavior are some of the biggest retailers.

U.K. retailer Boots leads brand efforts to invest in ad creative’s data layer

For media dollars to make an impact, brands need ad creative that actually hits. More CMOs are investing in pre- and post-flight measurement.

Ad position: web_bfu