Save 50% on a 3-month Digiday+ membership. Ends Dec 5.

This research is based on unique data collected from our proprietary audience of publisher, agency, brand and tech insiders. It’s available to Digiday+ members. More from the series →

Digiday’s “Research in brief” is our newest research installment designed to give you quick, easy and digestible facts to make better decisions and win arguments around the office. They are based on Digiday’s proprietary surveys of industry leaders, executives and doers. See our earlier research on the state of the agency world here.

At last month’s Hot Topic: Data-Driven & Content Marketing event in Tokyo, we sat down with 22 executives from brands, agencies and publishers to get their insights on data-driven marketing and connecting with consumers via social platforms.

Data poses unique challenges to brand marketers

Japan is one of the world’s largest advertising markets, with eMarketer forecasting $41.7 billion in total ad spending there in 2017. However, only 25 percent goes toward digital marketing. As a result, some say Japan’s digital advertising, especially data-dependent programmatic advertising, is still in its infancy. This is because Japanese ad tech companies develop isolated from more digitally mature markets and have to reinvent much of their technology.

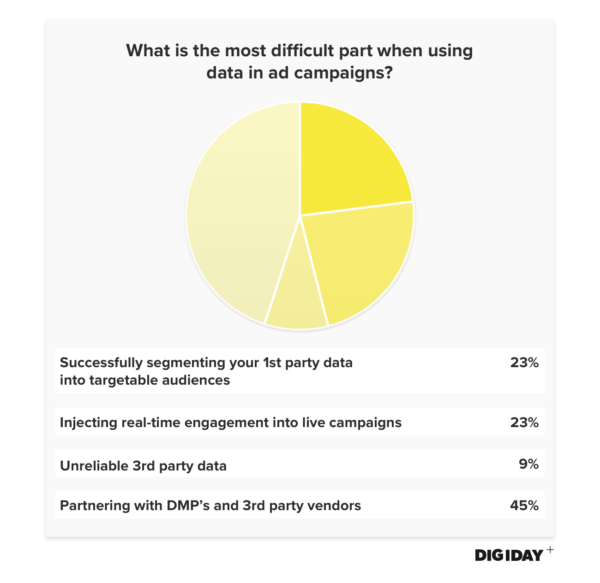

The lack of a mature ad tech market has left brands and agencies frustrated. When asked what the most difficult part of using data in ad campaigns is, the most common response was partnering with data management platforms and other third-party vendors. Sensing an opportunity, ad tech heavyweights Drawbridge and SpotX in addition to mobile retargeting platform Liftoff have all made entrances to the Japanese market in 2017.

Data is best used for understanding consumer behavior

Because 91 percent of Japan’s population uses the internet regularly and smartphone adoption is at roughly 65 percent, Japanese consumers are generating vast amounts of digital data for marketers to capitalize on. Daisuke Otobe, Shiseido Japan’s chief marketing officer noted that as information has become more ubiquitous, it has become commoditized.

Ad position: web_incontent_pos1

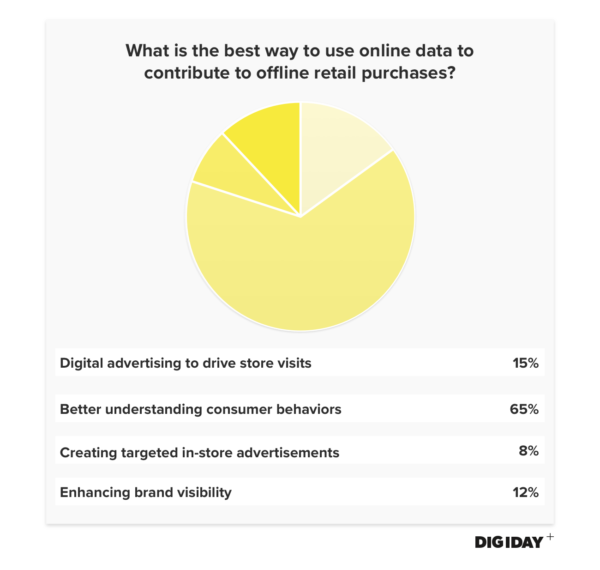

Japan’s marketers have a preferred use for their consumer data, with 65 percent of respondents saying the best use is developing a deeper understanding of consumer behavior. This is a marked shift in Japanese attitudes toward reliance and trust in scaled audience data. Despite data showing that highly targeted digital advertisements can drive purchasing behaviors, using digital ads for this purpose was a secondary concern.

Brands’ owned websites are the most important channel for content marketing

Japanese brands’ perception of themselves is starting to change, and many have taken a publisher-like approach to reaching consumers. In a panel discussion at the 2016 Advertising Week Asia conference, Tomotaka Mizukami, vp of content marketing for Yahoo Japan, described content marketing in Japan as nascent compared to the U.S. but growing. A study by native marketing company Grooover found that 83 percent of Japanese marketers are deploying content marketing strategies.

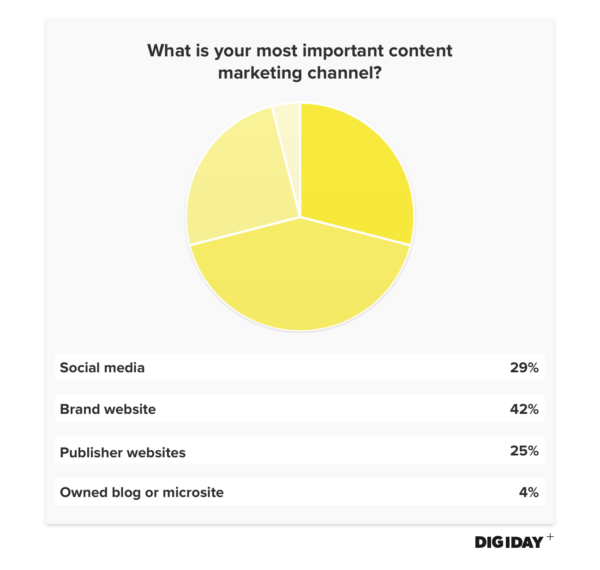

Brands undeniably place emphasis on content marketing on their own branded websites because it’s their sole opportunity to control the consumer’s environment. However, social platforms are increasingly playing a role. Ran Buck, svp of global revenue for Taboola, said in the same panel discussion that social platforms have the scale of users and consumer data that brands lack through their owned and operated websites. For brands aiming for product discovery and brand awareness, social platforms offer new and larger audiences that can be precisely targeted via content marketing campaigns.

Japanese marketers often use US platforms to interact with consumers

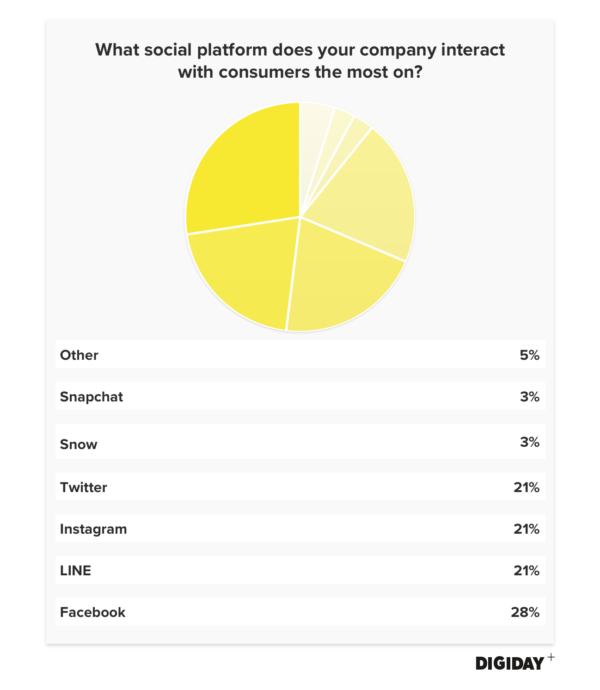

Three of the top four platforms Japanese marketers use to interact with consumers are from the U.S. Facebook was the top platform for marketers, although it ranks third among Japanese users, with a 33 percent usage rate, behind messaging app Line (76.9 percent) and Twitter (41 percent).

Ad position: web_incontent_pos2

This hasn’t stopped brands from using Facebook to reach consumers. Sixty-seven percent of luxury retail brands have made Japan-specific company pages for Facebook, compared to just 36 percent on Line, according to an L2 report.

More in Marketing

Ulta, Best Buy and Adidas dominate AI holiday shopping mentions

The brands that are seeing the biggest boost from this shift in consumer behavior are some of the biggest retailers.

U.K. retailer Boots leads brand efforts to invest in ad creative’s data layer

For media dollars to make an impact, brands need ad creative that actually hits. More CMOs are investing in pre- and post-flight measurement.

Ad position: web_bfu