Save 50% on a 3-month Digiday+ membership. Ends Dec 5.

A U.K. media insider conjures up a suitable sporting analogy when asked about the biggest challenge that awaits the successor to The Guardian CEO David Pemsel, who is leaving to become chief exec of the Premier League at some point before April next year: Winning the Premier League isn’t the hardest part. The hardest part is defending it.

Under Pemsel’s leadership, The Guardian News & Media recorded a return to operating profit this year after two decades of running up hefty financial losses. The publisher also defied skeptics with an ambitious shift in strategy to derive more of its revenue directly from readers — from one-off donations to regular contributions — all while not erecting a solid paywall.

But for all of The Guardian’s recent innovation, its three-year journey to financial break-even under Permsel was also driven by an aggressive cost-cutting strategy. The paper axed hundreds of jobs, the famous “Berliner”-style print newspaper was shrunk down to a tabloid size and it halted plans to open a 30,000-square-foot events venue around the corner from The Guardian’s HQ in London’s King’s Cross neighborhood — all to cut costs by 20%.

There is now considerably less fat left to cut.

“The first phase is to take the business by the scruff of the neck and say, ‘We are a business’ and be unapologetic about that,” said Douglas McCabe, CEO and director of publishing and tech at Enders Analysis.

The next stage poses a complex dilemma that involves balancing two very different business models, said McCabe: The readers who pay and the monetizing the ones who don’t.

The overall environment for all publishers isn’t any easier in 2019 than it was three years ago, either. Google and Facebook still dominate online ad spend, newsstand revenue across the board faces terminal decline and new privacy regulations and moves from browsers to limit tracking are making it harder for publishers to sell advertisers their audiences using third-party cookies.

Ad position: web_incontent_pos1

“Through the strategy implemented since 2016 we have laid the foundations to create a more reader-funded, more digital and more international business which can respond to the ongoing challenges in the global media sector,” said a Guardian Media Group spokesman. “Despite the success of our strategy, it is clear that significant challenges and turbulence remain for all news publishers across the industry. We have a clear strategy to maintain financial sustainability.”

Through interviews with industry observers, ad buyers and current and former Guardian staff, Digiday takes a look at what kind of to-do list will be waiting on the desk of the publisher’s new chief executive as they settle into the new job.

A “united front”

Pemsel, a former advertising executive-turned-marketer, began his career at The Guardian as a consultant before becoming its chief marketing officer in 2011. He quickly elevated the ranks into the top job in 2015, replacing Andrew Miller as chief executive. A year later, Pemsel, alongside newly appointed editor-in-chief Katharine Viner set the wheels in motion on a three-year turnaround plan for The Guardian to reach financial break-even.

Current and former Guardian staffers praised the “united front” Pemsel and Viner presented when presenting updates to both the editorial and commercial teams about the business. Pemsel and the Guardian’s CFO Richard Kerr also present the company’s financials internally each quarter to both teams, something staffers said didn’t happen as often under the old regime. Insiders said they hoped the same level of financial transparency would continue under a new CEO.

The search for a successor is underway and the nominations committee of The Guardian Media Group board is assessing “a range” of candidates, the spokesman said.

Ad position: web_incontent_pos2

Speculation both inside and outside The Guardian has pointed toward two logical internal candidates: Anna Bateson, a former Googler who joined The Guardian in 2016 and has led the publisher’s fledgling membership strategy — she became the newspaper’s chief customer officer in 2017 — and Evelyn Webster, a Brit who lives in the U.S. and runs the Guardian’s U.S. and Australian arms, which are both small but growing profitably. International revenue has doubled between 2015-2016 and its latest financial year, overcoming a shaky start. Prior to joining The Guardian, Webster was an executive vice president at Time Inc. and previously served as chief executive at IPC Media.

As for external candidates, Martin Tripp, founder of U.K. executive search firm Martin Tripp Associates (which is not working for The Guardian on this particular exercise) said someone with a media background will be preferred, but won’t be a deal-breaker. The pay may put off some high-flying executives — Pemsel’s total salary for 2018-2019 was £706,000 ($908,000).

“The Guardian model is going to attract people who see it as a vocation to some extent,” Tripp said. “Or, as it was with [Carolyn McCall, Guardian CEO between 2006 and 2010], someone who is in their first big chief executive role.”

Show me the money

If phase one of The Guardian’s turnaround was about achieving financial break-even, phase two is to achieve financial stability.

The Guardian has a unique ownership model in The Scott Trust Limited endowment fund, which invests its profits to sustain The Guardian’s independent journalism. Ahead of the recent turnaround, The Guardian had been unsustainably leaning on the fund each year as it burned through cash and amassed huge losses. The Guardian’s key target now is to ensure its adjusted net operating cash flow doesn’t exceed the £25 million-£30 million ($32 million-$39 million) average returns the fund is expected to generate over the long term.

Revenue diversification will be key to this strategy. The Guardian has set out a target to reach 2 million paying members by 2022. The publisher attracted 655,000 regular paying supporters plus 300,000 one-off contributors in the 12 months to March 2019. Reader revenue accounted for 28% of the total £224.5 million ($289 million) The Guardian Media Group generated in 2018-2019, up from 18% in 2015-2016.

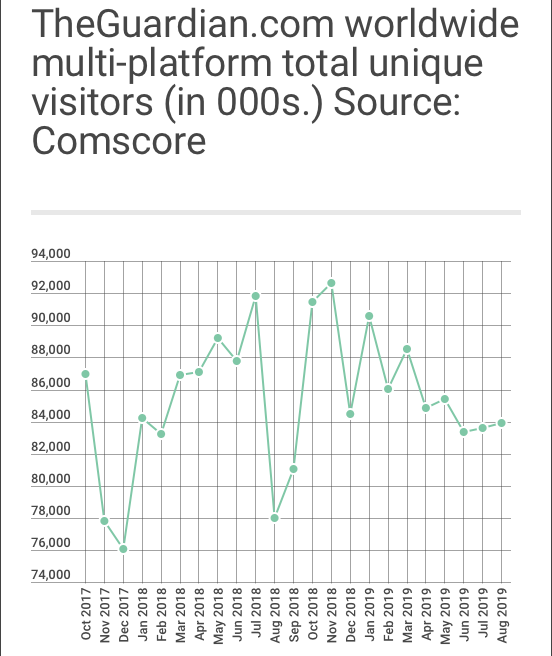

The website’s global traffic has fluctuated over the past two years, from about 76 million unique visitors in December 2017 to a peak of almost 93 million in November 2018, according to Comscore data.

The Guardian has recently launched a slew of subscriber-only products as it looks to provide more value to its paying supports, including a daily app that doesn’t carry ads and a premium tier in its regular app. New launches extend beyond digital, too: Last year, it launched an international weekly news magazine.

Advertising remains a large proponent of The Guardian’s revenue, accounting for 40% of the total last year. Buyers and industry experts praised The Guardian’s “strong” and “intelligent” commercial team that tends to look at the broader picture. Still, they noted some areas for improvement.

“There will be times when they don’t get business because they are not as malleable, frankly, as other publishers because of the division between editorial and advertising,” said Andrew Stephens, co-founder of media agency Goodstuff.

As The Guardian accelerates towards the 2 million-member mark, it will amass a stronghold of valuable user data. But fitting for a newspaper that broke the Facebook-Cambridge Analytica scandal and the Edward Snowden NSA leaks before that, buyers said The Guardian is not as forthcoming as rival publishers about potential data partnerships.

Thomas Laranjo, managing director at media agency Total Media, said that “one area where the Guardian could probably do better commercially is to forge more exciting, innovative partnerships with other media outlets and partners,” such as sports rights holders.

A Guardian Media Group spokesman said the boundaries between editorial and commercial are critical to the trust both readers and advertisers have in the newspaper. Sharing more data could place that at risk and would be unlikely to deliver significant long-term value, the spokesman said. He added that the company “is always looking for more ways to realize more revenue based on the quality of our sports journalism.” Sports/advertiser partnerships forged with The Guardian this year include Natwest bank sponsoring its cricket coverage and Visa sponsoring its coverage of the Women’s Football World Cup.

A brand-new hope

The Guardian launched a global brand campaign in September this year, centering around the message “Hope is Power.” The hope, from The Guardian at least, is that the ads will encourage more readers pay for the newspaper’s journalism.

Meanwhile, The Guardian’s call-to-action messages at the bottom of article pages asking readers to support its journalism are increasingly focusing on hot-button issues, such as climate change or abortion rights in the U.S.

The Guardian’s decision to opt for a Wikipedia-like donation strategy, rather than erecting a traditional paywall, also means it stays free for others who might not be able to afford a regular subscription.

“That’s the gift the members give the world as opposed to just themselves: a noble purpose,” said Nils Leonard, co-founder of Uncommon, the creative agency behind the “Hope is Power” campaign. He said he hopes to create more advertising for The Guardian communicating this type of message.

Still, appealing to two different types of audience, simultaneously, requires a change in mindset across an organization that has already weathered a great deal of upheaval. And within the media industry, constant change is already a way of life as it is — even without any executive turnover. Staffers will be wary a new CEO will bring yet another radical shift to their way of working.

“Structural change never comes without its challenges to business culture. Phase one has tackled many of these, but the underlying need for change has not stopped,” said Enders’ McCabe.

More in Media

What publishers are wishing for this holiday season: End AI scraping and determine AI-powered audience value

Publishers want a fair, structured, regulated AI environment and they also want to define what the next decade of audience metrics looks like.

Digiday+ Research Subscription Index 2025: Subscription strategies from Bloomberg, The New York Times, Vox and others

Digiday’s third annual Subscription Index examines and measures publishers’ subscription strategies to identify common approaches and key tactics among Bloomberg, The New York Times, Vox and others.

From lawsuits to lobbying: How publishers are fighting AI

We may be closing out 2025, but publishers aren’t retreating from the battle of AI search — some are escalating it, and they expect the fight to stretch deep into 2026.

Ad position: web_bfu