Save 50% on a 3-month Digiday+ membership. Ends Dec 5.

Publishers face difficult tradeoff in making coronavirus coverage free

Reader worry – and work from home policies – are driving a surge in news consumption about the coronavirus, with pageviews up 30% year over year, according to Parsely data.

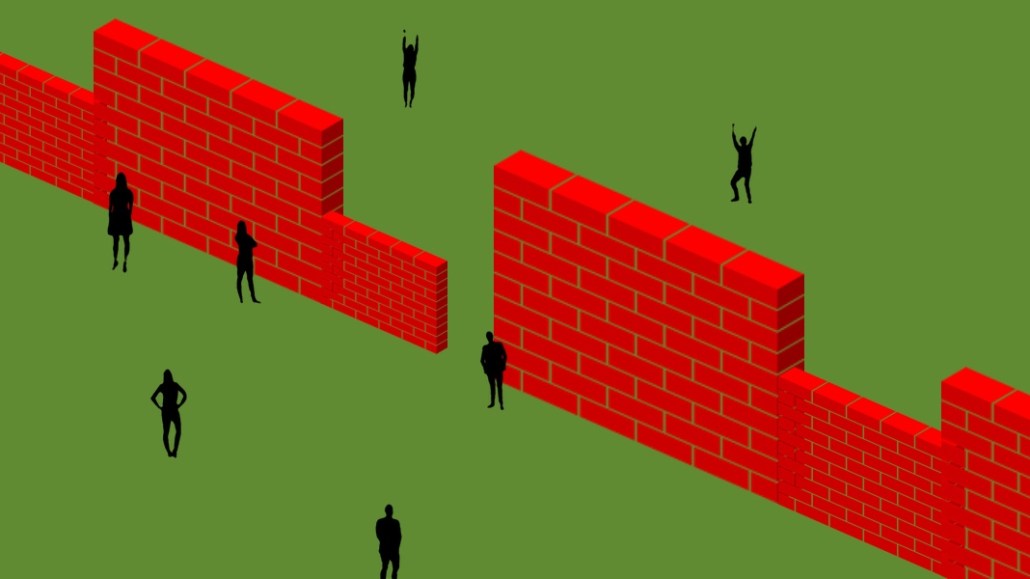

But publishers face a tough choice when it comes to using this reader interest. Even though readers are intensely worried in coronavirus coverage, it is difficult to monetize with advertising, with advertisers throwing keywords associated with the virus onto block lists. What’s more, as the scope of the virus’s impact widens, publishers also face pressure to move their stories about the virus in front of their paywalls, stunting a key area of revenue growth.

Approaches to this uncomfortable problem vary.

Some publishers are creating coronavirus exceptions for their paywalls. At Tribune Publishing, coronavirus stories are whitelisted at editors’ discretion, and they count toward readers’ monthly article limits, though readers who have reached their monthly limit can still read those whitelisted stories, a source familiar with the strategy said.

Some publishers are treating it as an opportunity to spread their content to as many new readers as possible. The Wall Street Journal began assembling a standalone section of free coronavirus content last month, with a running feed of news updates, a Q&A section of their site, and daily videos all available for free, without limit. To ensure that its coronavirus content gets the biggest possible reach, the Journal has been embedding messages in its coronavirus stories encouraging readers to share that content with their friends and family to maximize its exposure.

Others are extracting a bit more information in exchange for their content. The New York Times, for example, still requires that visitors register to read content on its site, though coronavirus coverage does not count against its paywall meter. The Times did not make an executive available to discuss its strategy.

Some business-focused publications have gone the other way. The Wrap, for example, which covers film and television, has moved more of its reporters onto a unit dedicated to producing content for the Wrap Pro, a premium subscription product it launched in 2018. Last Friday, Wrap Pro subscribers got eight exclusive stories, up from the two or three promised as part of their subscription.

Ad position: web_incontent_pos1

Though not all of the Wrap’s coronavirus coverage is exclusive to subscribers, CEO Sharon Waxman hopes the Wrap’s most impactful coverage of the virus’s effects on industry can help drive subscriptions. The site launched a promotion this week that gives subscribers a free week of access to The Wrap Pro.

“Hopefully we become an indispensable part of their daily lives,” Waxman added.

So far, readers’ intense need for information has been good for business. Since pivoting most of its newsroom to focus on the coronavirus about two weeks ago, The Atlantic had its single best week of subscriber growth, even though their coronavirus coverage not counting against its metered paywall, Atlantic editor in chief Jeffrey Goldberg said.

Stat News, a health and science publication owned by Boston Globe Media, decided to put all its public health reporting about coronavirus in front of its hard paywall. As a result, traffic has soared 225% over the first two months of the year, chief revenue officer Angus Macaulay said, but the site’s newsletter and digital subscriber rates have stayed the same as traffic has climbed.

And through the first half of March, the subscription start rate has more than doubled for the Seattle Times, which has had almost its entire newsroom covering the virus since it began spreading through Washington state, svp Kati Erwert said.

Ad position: web_incontent_pos2

It’s not clear how long this wave of support might last, so some publishers are thinking through how to retain the subscribers they’ve attracted. The Journal is exploring the idea of offering lower-than-usual renewal rates to members it’s brought on with the help of its coronavirus coverage, said Karl Wells, the Journal’s gm of membership.

“I’m conscious not to be celebratory about this,” Wells said. “But I’m pleased we can offer something people need.”

More in Media

What publishers are wishing for this holiday season: End AI scraping and determine AI-powered audience value

Publishers want a fair, structured, regulated AI environment and they also want to define what the next decade of audience metrics looks like.

Digiday+ Research Subscription Index 2025: Subscription strategies from Bloomberg, The New York Times, Vox and others

Digiday’s third annual Subscription Index examines and measures publishers’ subscription strategies to identify common approaches and key tactics among Bloomberg, The New York Times, Vox and others.

From lawsuits to lobbying: How publishers are fighting AI

We may be closing out 2025, but publishers aren’t retreating from the battle of AI search — some are escalating it, and they expect the fight to stretch deep into 2026.

Ad position: web_bfu