Save 50% on a 3-month Digiday+ membership. Ends Dec 5.

Cheat Sheet: Nielsen studies show ‘light’ listeners make up nearly half of podcast audience

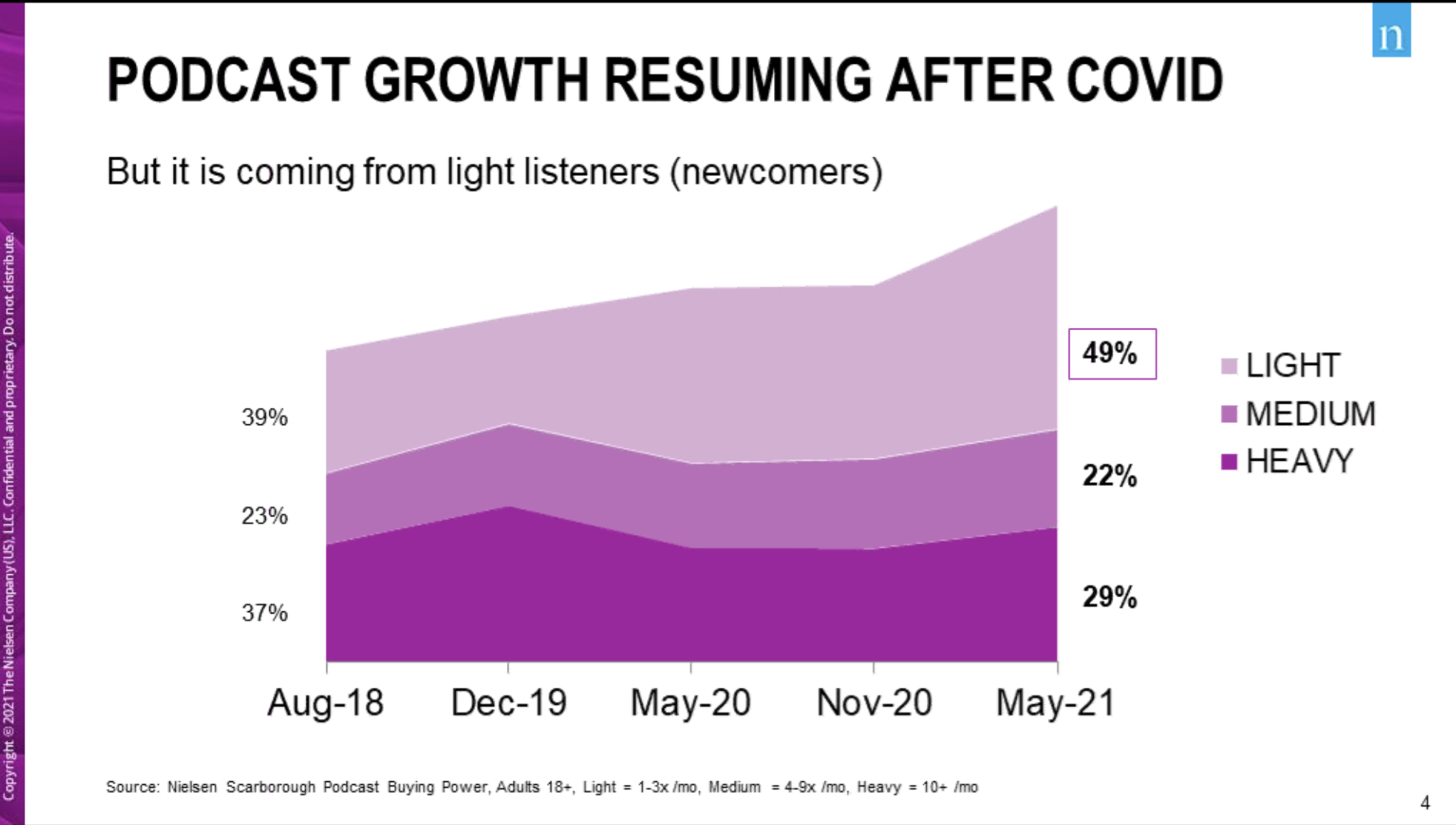

“Light” podcast listeners — or those that listen to a podcast one to three times a month — now make up nearly half of podcast listeners, up 10% in May 2021 compared to August 2018, according to a Nielsen webinar on June 15 that highlighted podcast trends from the measurement provider’s Podcast Buying Power survey and Podcast Ad Effectiveness studies.

In 2018, podcast listeners were “pretty evenly distributed” between light, medium (those that listen four to nine times a month) and heavy listeners (those that listen 10 or more times a month), according to Tony Hereau, vp of cross platform insights at Nielsen. It’s unclear to what extent the light listener trend observed by Nielsen indicates that heavier podcast listeners are cutting back on their consumption or that more people are dabbling with this form of audio-based news and entertainment.

Companies like Spotify and Facebook are investing in podcast hosting and players, so people who would otherwise be on these platforms for music or social interactions are “being pushed in the direction of podcasts,” said Hilary Ross, vp of podcast media at Veritone One.

An increase of light podcast listeners “shows us there is a lot of dabbling in this space, and the hope is that this is a sticky medium, and it can convert them to heavier users,” she said. “We want people who are going to convert. If it’s the first or 15th podcast they listen to all week, as long as we are serving relevant ads and relevant messages to them, that’s what we care about.”

Audience trends

The number of people who have listened to a podcast in the last 30 days has picked back up again in 2021, after a decline in 2020, according to Hereau. Nielsen declined to provide actual numbers, which the company said is exclusive to subscribers. (About 80 million Americans are now weekly podcast listeners, a 17% increase over 2020, according to Edison Research’s Infinite Dial 2021 report.)

Ad position: web_incontent_pos1

Nielsen’s podcast measurement shows there are 1.4 million podcast series out there and 57 million episodes, Arica McKinnon, vp of solutions consulting at Nielsen, said during the presentation.

Those people who listen to podcasts while in transit took a dip from 2018 to 2021, from 41% to 35%. Meanwhile, for obvious reasons such as more people working from home now than in previous years, there was an increase in podcast listening at home, from 40% in 2018 to 50% in 2021. Gen X make up the largest portion of podcast listeners, representing 42%. That hasn’t changed much since 2018, up by 2%.

Gen X listeners were “early adopters” of podcasting, and they “continue to have a strong hold here,” Ross said. She found it unsurprising that podcast consumption at home has increased, especially as this was par for the course this past year with the pandemic keeping people indoors. “With the advent of shorter form podcasts that have increased in popularity, we are seeing a higher consumption of those listening on smart speakers, and consuming at home,” she added. However, as people resume travel this summer and commute to their offices as workplaces start to open back up, Ross expects this to change soon.

Comedy is the most popular genre of podcasts as of May 2021, with 43% of all podcast listeners tuning into comedy podcasts, according to Hereau. News podcasts are next, at 38%, followed by society & culture, true crime, education, music and business. There were “big gains” for five niche genres from November 2020 to May 2021, Hereau said: a 21% gain for both science and fiction podcasts, a 12% increase for true crime podcasts, 10% for arts and 8% for technology.

Advertising trends

Ad position: web_incontent_pos2

CPG, finance and technology were the top-performing advertising sectors in podcasts in Nielsen’s report, Hereau said. These categories had key performance indicators like “awareness” and “info seek intent” increase by double digits, he said, “significantly higher” scores compared to other categories that usually have five to 12 point “lifts” in these KPIs.

Nielsen’s data shows that, on average, 70% of listeners exposed to podcast ads are able to recall the brand. The brands that had the highest ad recall scores in most of Nielsen’s studies were in the automotive, financial services, CPG, retail, media and telecommunications categories, McKinnon said.

However, other types of advertisers are moving into the podcast market. Amid the pandemic, Veritone One’s clients in subscription delivery services, email marketing services and customized products have had success with podcast advertising, Ross said, “not just the handful of categories” highlighted in Nielsen’s studies.

“These are positive trends, supported by other research that’s been released in this space,” Ross said about Nielsen’s findings. These types of studies “illustrate the continued growth and trust of this channel, and listener trust in these brands, and trust of talent,” she said.

More in Media

What publishers are wishing for this holiday season: End AI scraping and determine AI-powered audience value

Publishers want a fair, structured, regulated AI environment and they also want to define what the next decade of audience metrics looks like.

Digiday+ Research Subscription Index 2025: Subscription strategies from Bloomberg, The New York Times, Vox and others

Digiday’s third annual Subscription Index examines and measures publishers’ subscription strategies to identify common approaches and key tactics among Bloomberg, The New York Times, Vox and others.

From lawsuits to lobbying: How publishers are fighting AI

We may be closing out 2025, but publishers aren’t retreating from the battle of AI search — some are escalating it, and they expect the fight to stretch deep into 2026.

Ad position: web_bfu