Save 50% on a 3-month Digiday+ membership. Ends Dec 5.

Benefit Cosmetics has seen an uptick in customers who enter the store in search of specific products they’ve seen on the brand’s Instagram account. As a result Benefit, one of the members of the “millionaires club” (brands with more than a million followers on Instagram) is part of a growing number of fashion and beauty brands that are betting their social marketing dollars and resources on Instagram over any other platform.

Claudia Allwood, director of digital marketing in the U.S. for the brand, said that compared with platforms like Pinterest, “the impact is much greater,” she said. “[Instagram] is really our top priority.”

Benefit is not alone. A spokesperson from Estée Lauder, which saw a huge follower jump after announcing a partnership with model Kendall Jenner on the platform, said it’s the brand’s fastest-growing platform. “We want to be where our consumers are, and our customers and beauty enthusiasts love Instagram because of its visual and easy-to-consume nature,” she said.

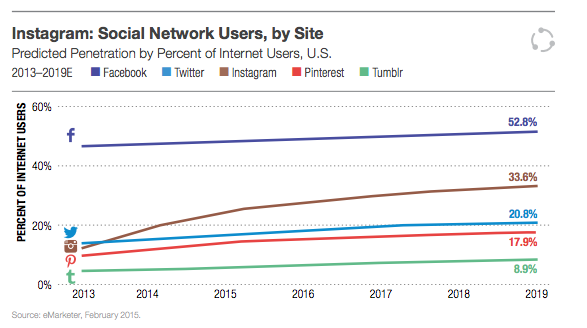

Instagram is blowing up: Fully a third of the world’s Internet population is expected to be on the photo-sharing site by 2018. Image-oriented by their very nature, fashion and beauty companies are investing heavily in the platform as it gains in popularity: 98 percent of L2’s top fashion brands are on Instagram as of this month, and 95 percent of beauty brands are on the platform — up from 75 percent and 78 percent in October 2013.

The frequency with which they post has also skyrocketed: up 17 percent for fashion and 42 percent for beauty.

And as Instagram opens its API to all advertisers, that rate is expected to continue to grow. For companies that had previously been shut out, it’s an opportunity to get onto a popular social platform on the cheap.

Ad position: web_incontent_pos1

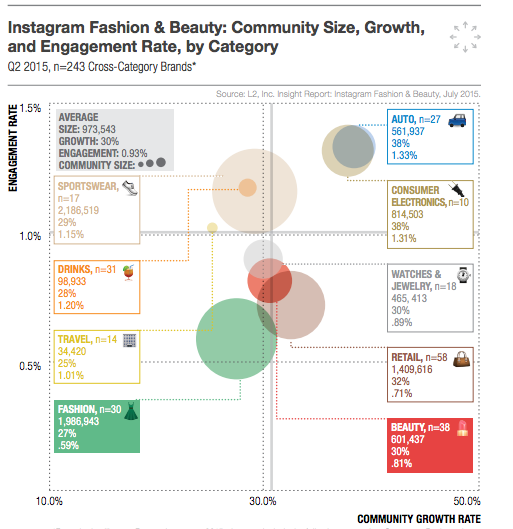

For beauty and fashion brands, engagement and interactions are higher on Instagram compared to any other platform. As of the second quarter of the year, of the 67 top fashion brands on social media, engagement is up 77 percent, while frequency of posting has shot up from just over 8 posts a week to 10 posts a week.

Standouts, according to L2, include Chanel, which joined the platform in October 2014 and amassed a following of 1.8 million almost overnight. For beauty, it’s the same story: Beauty brands are posting about seven times a week today, up from about five times at the same time last year.

“When we’re looking at the scale and platform stickiness of Instagram versus Pinterest or Tumblr, Instagram has really taken off,” said Claude de Jocas, intelligence group director at L2.

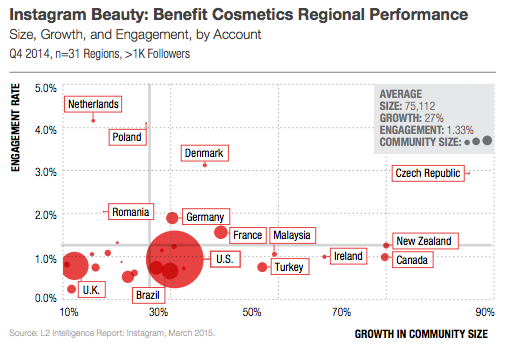

Because 70 percent of Instagram users are outside the U.S., global brands also do better on the platform. Many, like Benefit, have adopted a regionalization policy. So if mascara is huge in the U.S., the feed here will reflect that. In Asia, it might focus more on skin tints. “It’s easier to get people to connect to us on Instagram, especially if we can literally speak their language,” said Allwood.

Ad position: web_incontent_pos2

De Jocas said that as teenagers and younger millennials have fled Facebook, they’ve migrated over to Instagram.

While Facebook still attracts the lion’s share of paid advertising (82 percent of marketers surveyed by Forrester say they currently pay for ads on the site), brands are increasingly flocking to Instagram. About 46 percent of brands say they do or plan to pay money to get on Instagram in the next 12 months — the highest rate of growth compared with other platforms.

One other reason brands prefer Instagram to Facebook is that the bigger a brand gets on Facebook, the less its reach becomes. L2 found that for brands with more than 500,000 followers, reaching people is really hard. Instagram doesn’t have that problem. In fact, there was no negative correlation between how many people follow a brand and how many people engage with it.

Instagram’s higher ad rates may also be at play: buyers say Instagram costs between $100,000 and $500,000 for a monthly ad buy. “A lot of brands have been priced out, so the brands on there are luxury and aspirational,” said Garett Levy, a research analyst at L2.

High-end fashion brands are among the prolific on Instagram. For example, Christian Louboutin in January launched #louboutinworld, a photo gallery displayed on its homepage that goes directly to its Instagram page. Its followers there have grown 80 percent in the last year, while Facebook likes have grown only 8 percent. And 40 percent of all brands that stream user-generated content onto Instagram are beauty brands. One reason, according to de Jocas, is that product lines in beauty are relatively the same season-to-season, so brands have a nice reserve of user-generated photos they can pick from.

That means that Instagram’s biggest problem — no direct path to commerce — isn’t really much of a problem at all. While Instagram introduced clickable ads via its “carousel” platform back in March, brands are hoping that a more direct path to purchase (a “shop now” button, or a click to buy capability) will eventually be introduced. But until then, Instagram still makes more sense for brands that want engagement and inspiration.

Denna Singleton, who heads global marketing at Elizabeth Arden, has effectively moved the brand’s focus from Pinterest onto Instagram, citing higher engagement and better bang for the buck. “It costs a lot of resources” to shoot original photos, so the brand also relies on user-generated pictures. She’s waiting for Instagram to roll out more “shop now, buy now” buttons, but in the meantime, carousel ads and an integration with Facebook that shows the user the product on Facebook after she sees it on Instagram is enough. Arden uses third-party workarounds like Like2Buy to close the purchase loop. For Benefit, it’s the same thing: “It’s a very manual process right now,” said Allwood. “But it works.”

More in Marketing

Ulta, Best Buy and Adidas dominate AI holiday shopping mentions

The brands that are seeing the biggest boost from this shift in consumer behavior are some of the biggest retailers.

U.K. retailer Boots leads brand efforts to invest in ad creative’s data layer

For media dollars to make an impact, brands need ad creative that actually hits. More CMOs are investing in pre- and post-flight measurement.

Ad position: web_bfu