Save 50% on a 3-month Digiday+ membership. Ends Dec 5.

Future of TV Briefing: How Amazon, Roku and YouTube are figuring into this year’s TV upfront market

This Future of TV Briefing covers the latest in streaming and TV for Digiday+ members and is distributed over email every Wednesday at 10 a.m. ET. More from the series →

This week’s Future of TV Briefing looks at how Amazon, Roku and YouTube stand to play a bigger role in this year’s upfront market after leveling up in the last couple years.

- Upstream TV

- Streaming viewership hits highwater mark

- Streaming’s belt-tightening era, Netflix’s long-term subscriber loss, TikTok’s live subscriptions test and more

Upstream TV

The key hits:

- The upfront gap between traditional TV networks and streaming-only sellers has closed.

- This year some agencies may strike their first upfront deals with Amazon, Roku and YouTube.

- The streaming-only sellers’ flexible upfront deals models also factor in, though those models may be changing this year.

In last year’s TV advertising upfront market, TV networks were willing to turn away linear TV ad dollars to move money to their respective streaming and digital properties. In this year’s upfront market, that move may come back to bite the networks. Some of that money did end up moving to streaming and digital, but it moved to other companies’ streaming and digital inventory and may not return to the TV networks given Amazon’s, Roku’s and YouTube’s rising roles in the upfront market, according to agency executives.

“We warned [the TV networks] last year: ‘Don’t overplay your hand because all your going to do is you’re going to force clients to shift money into some of these digital platforms that have great audiences, data, great measurement, great ability to prove that they’re reaching incremental audiences that you’re not reaching on TV. And once the money goes over, they’re not coming back,’” said one agency executive.

“People thought they could push money away, and it would just come back, and it doesn’t,” concurred a second agency executive.

This migration of money to companies including Amazon, Roku and YouTube is creating the conditions for the playing field to further level between traditional TV network owners and streaming-only sellers in this year’s upfront. “NBCU, Disney, Fox, Warner Bros. Discovery, Paramount, Amazon, Google, Roku — that’s where 80% of the marketplace gets spent,” said a third agency executive.

Historically, the streaming-only sellers took a backseat to the TV networks in the upfront negotiations. Advertisers and agencies struck their deals with the TV networks first and then moved on to haggling with Amazon, Roku and YouTube. But over the past two years, that gap has effectively closed to the point where, in some cases, the streaming-only sellers are securing the first deals.

“YouTube’s been one of our first deals a couple of years in a row, as has Roku,” said Stacey Stewart, U.S. chief marketplace officer at UM Worldwide. “Whether they will be this year, time will tell. We look at them all at the same time. We don’t have windows anymore.”

“You’re going to see more agencies and clients push for broader deals or bigger deals across YouTube, Roku, Amazon, for sure,” said the second agency executive.

Agency executives were leery of discussing, on record or anonymously, what share of upfront dollars they expect will go to the streaming-only sellers versus the TV networks this year, but they did say that they expect at least 30% but no more than 40% of the total volume of dollars committed in this year’s upfront to be earmarked for streaming overall.

Some agency executives who have continued to haggle first with the TV networks seem to be holding a bit of a grudge against the TV networks for their handling of last year’s negotiations and are now eyeing opportunities to overhaul their deal-making hierarchy. “We’re going to do our first upfront deals — the first in market that usually set the tone of the market — it could very well be with YouTube or Amazon,” said the first agency executive.

In short, after last year’s upfront market heavily favored sellers and particularly traditional TV sellers, buyers are heading into this year’s negotiations looking to even the balance and see the streaming-only sellers as a big bargaining chip that can now be used in the same way that the buyers play the major TV network groups against one another. “If Disney tells me that their pricing is plus-20[%], I can say, ‘Go screw yourself. I’m going to Paramount, and I’m going to YouTube,’” said the third agency executive.

Further favoring the streaming-only sellers is the relatively lax terms of their commitments. Unlike the TV networks that require advertisers to commit ahead of time to spend a set amount of money with fairly limited cancelation options, the streaming-only sellers typically strike so-called “endeavor” or “enterprise” deals, in which an ad deal is done at the agency level so the agency can spread it across its client portfolio and unlock certain inventory and/or pricing tiers as they spend more money with a CTV platform or streaming service throughout the year. These deals’ flexibility — further buoyed by adhering to the Interactive Advertising Bureau’s 15-day, 100% cancelation clause — may be especially in demand in this year’s upfront market given the macroeconomic conditions affecting advertisers’ businesses.

“Do you want to put your money somewhere where you’re committed — at least a large percentage of it — 14, 15 months out? Or do you want to work with somebody to get out in two weeks in terms of endeavors?” said the first agency executive.

Of course, capitalism being capitalism, agency executives have to be careful about the downsides of rebalancing the upfront market too heavily toward the streaming-only sellers. For example, rising upfront demand being directed toward Amazon, Roku and YouTube could put those companies in position to make greater demands of advertisers and agencies in the upfront — potentially as soon as this year’s upfront.

“I believe Roku has been out talking about trying to have more specific deals tied to clients and less about the enterprise. It’s the same for YouTube,” said the second agency executive.

What we’ve heard

“The mid-sized or smaller TV players can’t afford to subscribe to Nielsen plus three others. It’s a really big issue. You’ve already got a lot of cost in the system from programmatic fees. Then as we get into more data-driven linear and advanced TV, that has its own set of fees. Here’s another set.”

— TV network executive on the additional costs introduced by supporting multiple measurement currencies

Streaming viewership hits highwater mark

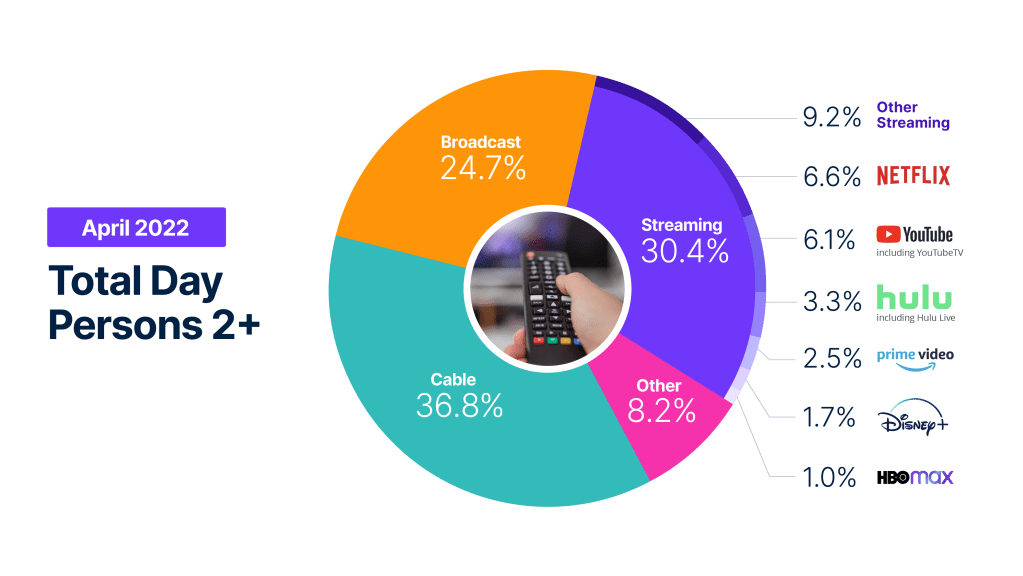

Despite the timing of Netflix’s glum first-quarter earnings report, April wasn’t an entirely gloomy month for streaming. The dominant subscription-based streamer may have hit a low, having lost subscribers, but streaming overall gained share of total TV watch time to reach a new high, according to Nielsen’s The Gauge report for April 2022.

Aside from streaming’s overall uptick, the viewership share breakdown by major streamers didn’t change all that much — with one exception. Warner Bros. Discovery’s HBO Max earned a callout for the first time by accounting for 1% of total TV watch time in April.

Splitting HBO Max from the “Other streaming” bucket would help to explain that bucket shedding 0.6 percentage points month over month. More to the point, it’s notable that the fact that “Other streaming” only dipped by 0.6 percentage points despite losing the 1 percentage point that HBO Max would have contributed if it hadn’t been broken out. Excluding the HBO Max impact, the “Other streaming” category appears to have gained share by 0.4 percentage points. That’s not a lot, but it would represent the biggest month-over-month gain in watch time among the listed streamers. Combined with HBO Max reaching Nielsen’s reporting threshold, these two developments evince how streaming viewership continues to spread beyond the historical who’s who, though the category still appears to be pretty top-heavy.

Speaking of slightly waning dominance, traditional TV still accounted for 61.5% of TV watch time in April, though broadcast TV’s share dipped by 0.2 percentage points and cable TV’s share slipped by 0.1 percentage point.

Numbers to know

21%: Estimated annual U.S. revenue bump that Netflix could receive by adding an ad-supported tier.

17.4%: Percentage share of Snap’s U.S. employees who are members of underrepresented racial and ethnic groups.

$2.99: Monthly subscription price for non-pay-TV subscribers to stream The Weather Channel’s live broadcast.

1.95 million: Number of subscribers that major U.S. pay-TV providers lost in the first quarter of 2022, slightly more than they shed in Q1 2021 but slightly less than in Q1 2020.

What we’ve covered

Disney’s Disney+ ad pitch reflects how streaming ad prices are set to rise in this year’s upfront:

- Disney is seeking CPMs for Disney+ around $50.

- Hulu, Amazon and Fox’s Tubi are also looking to press upfront advertisers to pay up.

Read more about streaming ad prices here.

Four takeaways on Upfront Week from a buyer’s perspective:

- The upfront market will start quickly but may stay open a while.

- TV networks’ presentations lacked the usual fall programming schedules.

Read more about Upfront Week here.

Why TV advertising’s measurement currency change won’t happen in this year’s upfront cycle:

- The inclusion of alternative measurement providers in this year’s upfront deals will be largely limited to tests.

- There remain discrepancies among measurement providers and other complications that need sorting.

Read more about TV advertising’s measurement currency change here.

As economic uncertainty grows, senior media buyers expect decent upfront pricing options across linear and digital:

- One ad buyer said they expect TV networks to secure single-digit-percentage CPM increases.

- Warner Bros. Discovery is looking for up to 40% increases in the amount of money advertisers commit with the company in this year’s upfront.

Read more about upfront buyers’ pricing expectations here.

Flexibility will be a focal point again in this year’s upfront negotiations:

- Ad buyers want to maintain the looser cancelation options secured in the last two years, while TV networks want to return to firmer terms.

- As likely as anything, the two sides will agree to maintain the current terms.

Read more about upfront flexibility talk here.

What we’re reading

Streaming’s belt-tightening era:

Netflix, Disney and Warner Bros. Discovery are taking steps to rein in their content costs, reflecting the end of streaming’s free-spending era, according to Bloomberg.

Netflix’s long-term subscriber loss:

While newer subscribers continue to account for a bulk of the customers Netflix loses each quarter, the share is increasing among those who have been subscribers for more than three years, according to The Information.

Warner Bros. Discovery’s disruptor in chief:

Former WarnerMedia CEO Jason Kilar may have been described as a disruptor, but the label appears to apply to Warner Bros. Discoveyr COE David Zaslav, who has quickly shaken up the new conglomerate by cutting costs and canceling projects like CNN+, according to The Wall Street Journal.

TikTok’s live subscriptions test:

This month TikTok will start testing an option for creators to sell paid subscriptions for people tuning into their live streams, according to TechCrunch.

Candle Media’s Spanish-language studio:

A week after Candle Media acquired digital video publisher ATTN:, former Disney executives Kevin Mayer’s and Tom Staggs’ media company announced it is acquiring Spanish-language TV and film producer Exile Content Studio, according to The New York Times.

More in Future of TV

Future of TV Briefing: The streaming ad upfront trends, programmatic priorities revealed in Q3 2025 earnings reports

This week’s Future of TV Briefing looks at what TV and streaming companies’ latest quarterly earnings report indicate about the state of the streaming ad market.

Future of TV Briefing: The creator economy needs a new currency for brand deals

This week’s Future of TV Briefing looks at why paying creators based on reach misses the mark and what IAB is doing to clear up the creator-brand currency situation.

Future of TV Briefing: WTF is IAB Tech Lab’s device attestation tactic to combat CTV ad fraud?

This week’s Future of TV Briefing breaks down the CTV ad industry’s new tool for fighting device spoofing.

Ad position: web_bfu