Save 50% on a 3-month Digiday+ membership. Ends Dec 5.

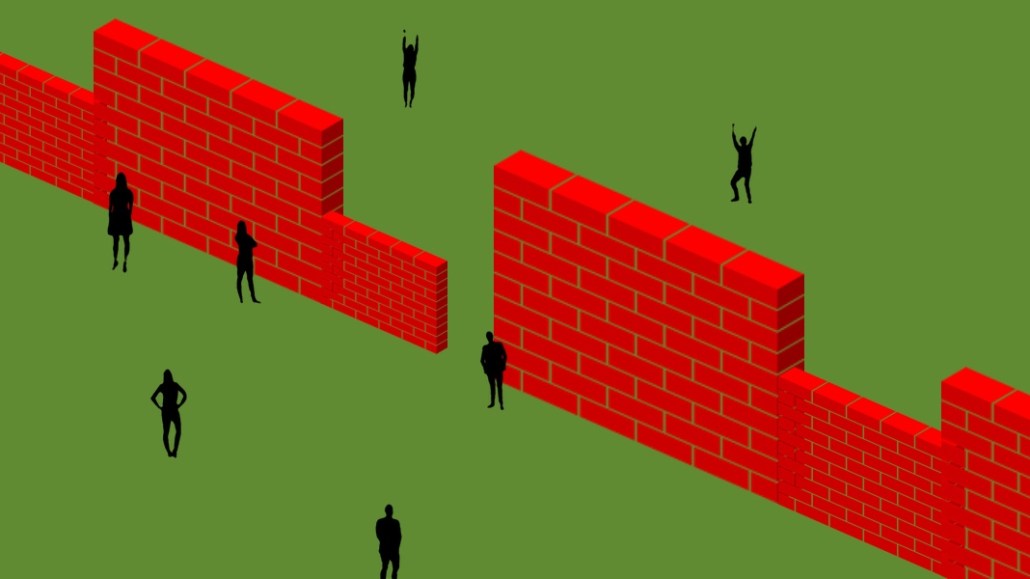

Publishers that flocked to building paywalls and membership programs are beginning to ask themselves an awkward question: What if their products are actually fueling their competitors’ businesses?

The paywall proliferation of the past few years has brought many people around to the idea of paying for news and other content online, and has at least socialized the idea that content on the internet isn’t, by definition, free.

But as people come to terms with the idea they’re going to have to pay for what they read or consume, there’s also a growing number of choices out there. Faced with those, many are gravitating toward the products that promise the most value and the biggest, broadest package of content they can. That’s great news for big-brand publishers, but for second-tier ones, there’s a growing concern that their paywalls are effectively serving as successful marketing for the offerings of their competitors, as opposed to building new, sustainable revenue streams of their own.

What’s more, there’s some evidence to suggest that many trigger-happy subscribers are, if anything, beginning to slim down the number of services they subscribe to rather than adding to them.

Scroll CEO Tony Haile suggested last week that this “paywall paradox” is helping to propel subscription growth for The New York Times, for example, which announced last week that it added 273,000 new digital subscribers in the third quarter to reach an overall print and digital subscriber number of 4.9 million.

Besides The New York Times, there’s a handful of other obvious candidates that stand to benefit, such as The Wall Street Journal and The Washington Post. The Washington Post’s subscriber base has “more than tripled in the past three years,” according to the company. News Corp reported a 19% increase in digital subscribers during the third quarter.

And of course, economies of scale enable those larger players to offer lower price points: to collect more data with which to hone their products and their marketing and retention strategies, and the virtuous cycle continues.

Ad position: web_incontent_pos1

Smaller, more focused, and perhaps niche publishers will most likely find themselves sheltered from this dynamic as well. As people become accustomed to paying for content, publishers with differentiated, focused content are in a good spot.

So, as is often the case in digital publishing, the middle is emerging as a dangerous place to be when it comes to subscription products and paywalls. Second-tier publishers with undifferentiated offerings are not only going to struggle to compete with the heft of titles such as The New York Times, but the very existence of their products could be helping to create demand that others are cashing in on.

One publishing exec told Digiday recently that his company had launched a paywall with the intention of “figuring out the product” later.

In hindsight, that perhaps doesn’t seem like such a great idea.

More in Media

What publishers are wishing for this holiday season: End AI scraping and determine AI-powered audience value

Publishers want a fair, structured, regulated AI environment and they also want to define what the next decade of audience metrics looks like.

Digiday+ Research Subscription Index 2025: Subscription strategies from Bloomberg, The New York Times, Vox and others

Digiday’s third annual Subscription Index examines and measures publishers’ subscription strategies to identify common approaches and key tactics among Bloomberg, The New York Times, Vox and others.

From lawsuits to lobbying: How publishers are fighting AI

We may be closing out 2025, but publishers aren’t retreating from the battle of AI search — some are escalating it, and they expect the fight to stretch deep into 2026.

Ad position: web_bfu