Save 50% on a 3-month Digiday+ membership. Ends Dec 5.

‘There is no long term now’: Why this crisis isn’t like previous financial downturns

This is the first of a weekly column I’m writing about the big changes and challenges facing media and marketing leaders. Be sure to join Digiday+, our membership program, to get access to this column and all Digiday articles, research and more.

If early indications are anything to go by, the coronavirus outbreak looks set to be the great accelerant for many of the trends already happening within the media industry, as the strong separate from the weak.

For media businesses who were already struggling pre-coronavirus, this is Darwinism on steroids. The ongoing consolidation of the sector will continue apace as the world moves toward a recession and possible depression. As Warren Buffett wrote to Berkshire Hathaway shareholders in 2001, as the dot-com bubble burst: “You only find out who is swimming naked when the tide goes out.” Indicators of media companies and vendors in severe distress — longer payment terms and layoffs — will be expedited, execs predict.

Publishers that were only just embarking on revenue diversification strategies have no choice but to jump in with both feet, with media consumption dramatically adjusting to this new way of life. Subscription businesses will need to assess their pricing mix to be reflective of the content they now offer (especially if they leaned heavily on travel or sports) and also be empathetic that many of their customers will have new financial constraints.“Uncertainty” is the word I keep hearing over and over again as I speak to media executives in the U.S. and Europe. The situation is so fast-moving that the conversations I had a week ago are often barely relevant today. ITV, the U.K.’s largest commercial broadcaster, said on Monday (Mar. 23) that not only was it withdrawing its market guidance for 2020, but that it wasn’t even able to provide guidance for March or April as deferrals from advertisers across many different sectors stack up.

Media executives are desperate for indicators as to how long things will take to shake out. I’ve been asking around about what lessons — if any — can be taken from previous recessions and applied to the current pandemic. Of course, direct comparisons aren’t easy. Publicis Groupe adviser Rishad Tobaccowala’s analogy: 9/11 plus the 2007-2009 financial crisis, “multiplied by two.” That would put the current crisis in the league of the Great Depression compared to the relatively mild and short-term economic downturns most have experienced in their careers.

In uncertain times, advertisers tend to rein in their spending as a reflex. But with industries like hospitality and travel cratering and consumer spending expected to dip, the impact on advertising will be enormous this time around. EMarketer has lowered its 2020 global advertising spend forecast down 2.85% to $691 billion and its analysts said it’ll likely revise that number down further later this year. (Global ad spend dropped 12.3% in 2009, according to Kantar Media.)

Peter Field, a U.K.-based independent marketing consultant advised clients in 2008 to maintain their level of ad spend if they could afford to do so. “If you can maintain your spend you find it buys you more advertising and your share of voice will rise,” he told me. Brands that weathered the last recession well “stuck to the big, emotional sell and didn’t go down the tactical promotional route.”

Ad position: web_incontent_pos1

Cadbury Dairy Milk, for example, launched its famous drumming “Gorilla” ad in 2007 and spent millions on other brand campaigns, while cutting back on promotional volume. The result? Cadbury said (in its 2010 IPA Effectiveness Awards entry) that the effort helped it win back marketshare from its main competitor Galaxy, which had been ramping up promotional activity over the same period.

The case studies are unlikely to sway many under-fire CFOs, though, as they look to chop spending as much of the global economy is, for all intents and purposes, closed for business. S4 Capital executive chairman Martin Sorrell told me the idea of marketers spending their way through this specific crisis is “complete nonsense,” given the existential threats so many companies currently face. That’s not to mention the health impacts on their workforces.

“In all the conversations I have had, [with business leaders], there is no long term now: it’s a total focus on the short term,” he said. “All bets are off.”

With the situation unfolding at lightning speed, media companies don’t have the luxury of time to be able to react. But one important takeaway from the industry veterans I spoke to was that this too shall pass. That’s a particularly important reminder for the media industry’s younger cohort who may have only entered the workforce in the past decade and have yet to experience a downturn in their careers. Still, it’s nowhere near clear yet what the new “business is usual” will look like. Keep well and stay safe.

How to lead through Coronavirus

Ad position: web_incontent_pos2

Over his near 40-year career, former Publicis Groupe Chief Growth Officer Rishad Tobaccowala has advised dozens of clients on steering through macroeconomic storms. He shared tips with me for media leaders looking to navigate the current crisis:

Capability. “The last thing a brand wants to look like is that they’re scared and don’t know what’s going on. If you keep quiet in a crisis, people will say, ‘What the hell happened to you?!’”

Integrity. “The world doesn’t know who to trust, so you need integrity. You don’t say something and do something else.”

Empathy. “Whether it’s to employees, or to customers, they are facing a very different world.”

Inspiration. “Everyone is down. Without being Pollyanna about it, look at how you can give people hope.”

Vulnerability. “[Communicate that] we are confused and scared too.”

Numbers don’t lie

It’ll come as no surprise that people are glued to news sites as the coronavirus situation escalates.

As we’ve been reporting at Digiday, these types of news-traffic uplifts don’t necessarily translate into the kind of revenue windfalls publishers so desperately need at this trying time. Many advertisers are blocking coronavirus-related keywords and topics from their digital ad buys and publishers face a tricky dilemma in deciding which articles should be placed behind paywalls.

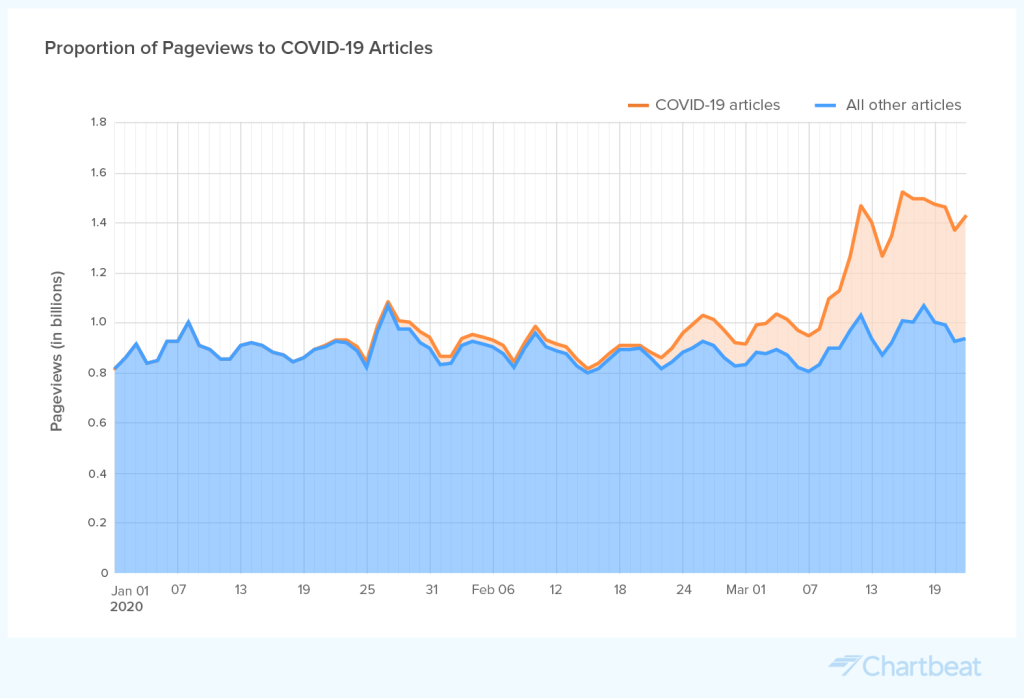

Still, the numbers are *huge* and any boost in traffic is an opportunity for publishers to promote their wider products. Chartbeat analyzed more than 80 billion pageviews across its network across Monday-Wednesday (March 16-18) compared to the prior Monday-Wednesday and dug into the data for Digiday:

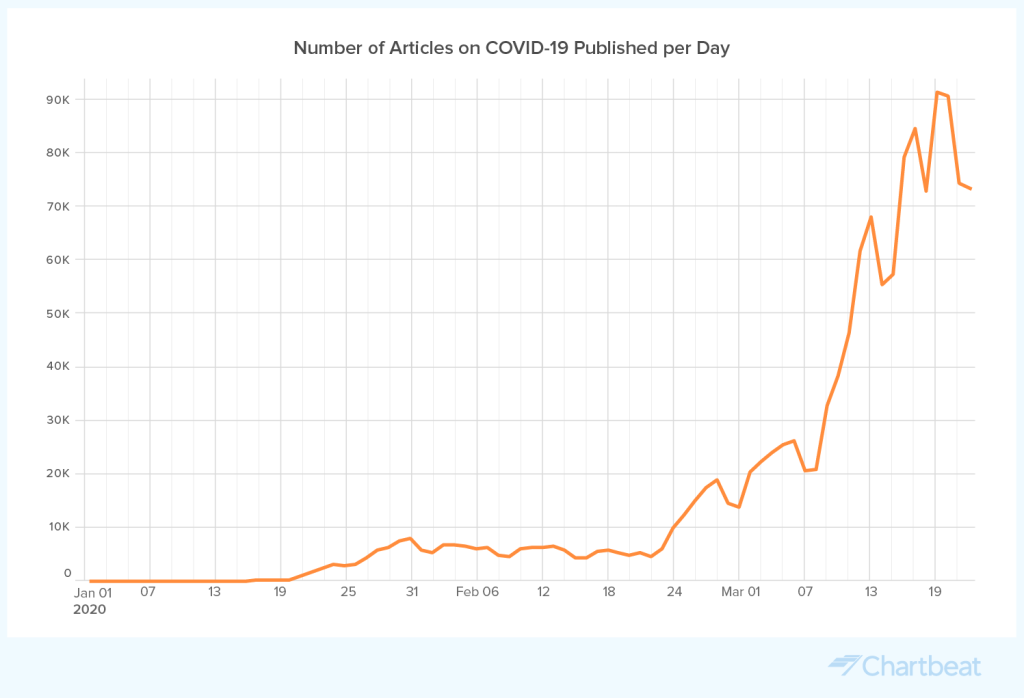

The number of articles about coronavirus published per day peaked on Mar. 19 at 90,000+

Coronavirus articles received around a third of all publisher pageviews.

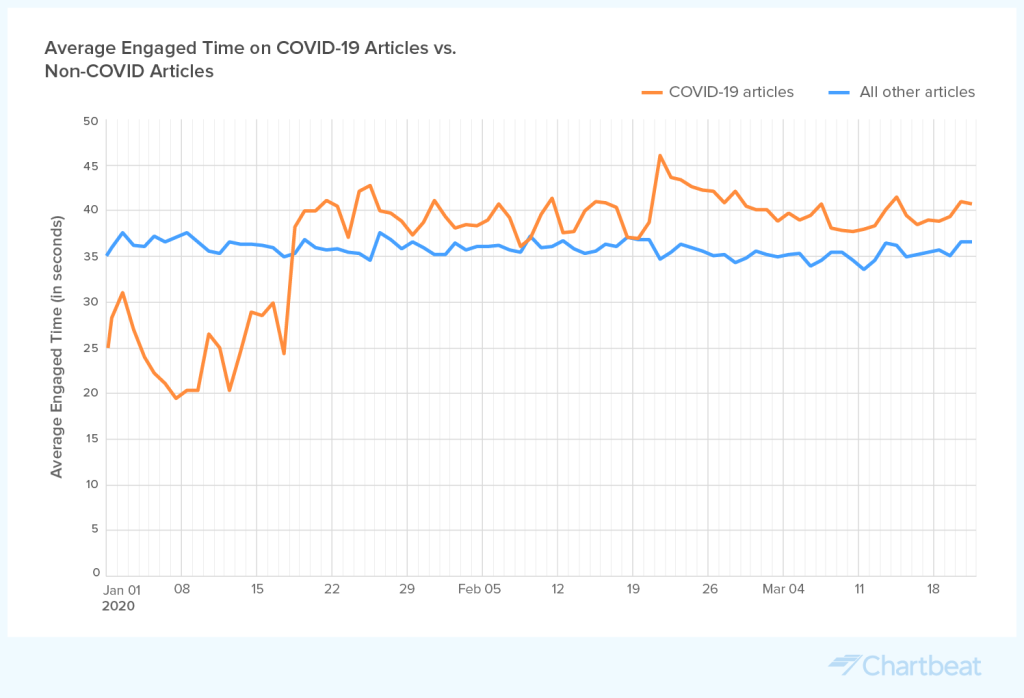

The average engaged time on coronavirus articles is around 40 seconds. Average engagement across all articles is just above 35 seconds.

Search and social patterns to coronavirus articles have largely mirrored each other, with social driving slightly more traffic to publisher sites. Typically, social traffic, when it includes dark social (visitors who arrived via emails, apps, instant messaging, or other platforms and webpages that do not permit the transfer of referrer data to your site) is about the same as search.

Yet Google search is driving more engaged time on articles than Facebook — in fact, the average engaged time from Facebook has dropped since Feb. 25.

More in Media

What publishers are wishing for this holiday season: End AI scraping and determine AI-powered audience value

Publishers want a fair, structured, regulated AI environment and they also want to define what the next decade of audience metrics looks like.

Digiday+ Research Subscription Index 2025: Subscription strategies from Bloomberg, The New York Times, Vox and others

Digiday’s third annual Subscription Index examines and measures publishers’ subscription strategies to identify common approaches and key tactics among Bloomberg, The New York Times, Vox and others.

From lawsuits to lobbying: How publishers are fighting AI

We may be closing out 2025, but publishers aren’t retreating from the battle of AI search — some are escalating it, and they expect the fight to stretch deep into 2026.

Ad position: web_bfu