Save 50% on a 3-month Digiday+ membership. Ends Dec 5.

Digiday Research: Publishers blur the lines between editorial and commerce

This research is based on unique data collected from our proprietary audience of publisher, agency, brand and tech insiders. It’s available to Digiday+ members. More from the series →

At the Digiday Hot Topic: Commerce for Publishers event in May in New York City, we surveyed 53 publisher executives to learn how publishers approach commerce initiatives. Check out our earlier research on where publishers sell their products here. Learn more about our upcoming events here.

Quick takeaways:

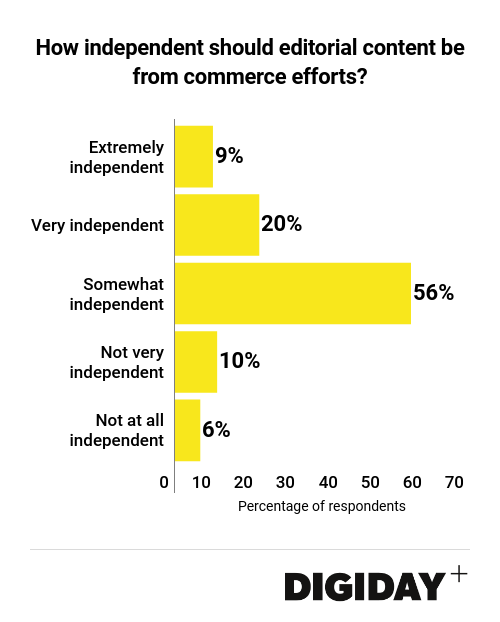

- Less than 30 percent of publishers in Digiday’s survey think editorial content should be independent from commerce efforts.

- Sixty-one percent of respondents said they use audience data to inform editorial content.

- Data that informs commerce decisions most often comes from audience development teams.

The wall between church and state crumbles

Editorial content is supposed to be objective and separate from outside interests or influences. However, that separation is diminishing as more publishers commit resources to promoting advertisers’ products in their editorial content. Now, commerce and editorial content have an uneasy relationship. When Condé Nast first announced that its editors would create ads, the backlash was fierce. Since then, attitudes have changed, with only 29 percent of publisher executives in Digiday’s survey saying editorial content should be independent from advertiser endorsements.

Some publishers have embraced the shift away from editorial independence. Both the “Today” show and Refinery29 use their editorial staffs to help create content that promotes specific advertisers and deals. Publishers including BuzzFeed have special teams creating commerce content that sit within their editorial teams.

Unable to rely on digital advertising revenues alone, publishers have pushed more aggressively to develop alternative revenue streams in recent years. Commerce revenues have become one of those streams. Forty-three percent of publishers in an earlier Digiday survey said part of their revenue came from e-commerce. Since few publishers operate brick-and-mortar retail stores, essentially all of their commerce revenue is from online sales. Affiliate revenue in particular has been a main driver of commerce revenues, with 53 percent of publishers at the Hot Topic event saying at least 75 percent of their commerce revenues came from affiliate links or sales.

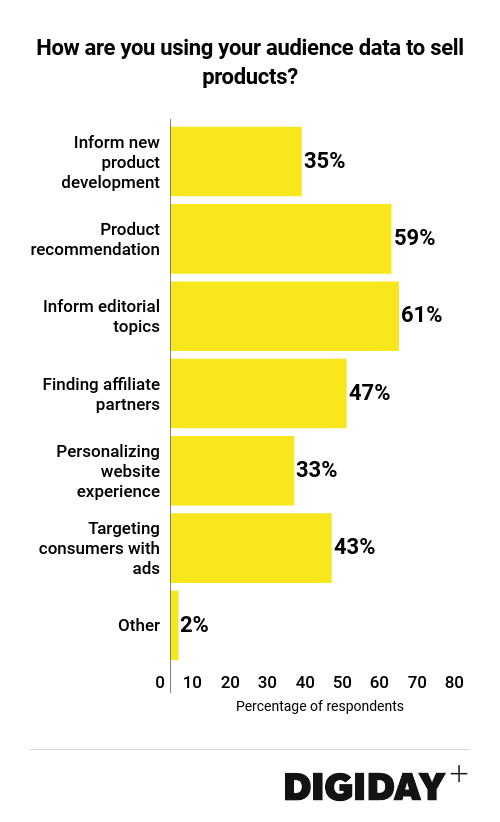

Audience data helps direct editorial focus

Publishers have no shortage of ways to use audience data, which includes information like users’ interests and income demographics, to sell products. Over one-third of publishers surveyed by Digiday at the Hot Topic event use audience data to develop new products. Yet product development based on audience insights was far from the most popular use case, with over 60 percent of respondents saying their companies use audience data to drive their editorial strategy. That makes sense, given publishers’ dependence on affiliate links in their commerce content.

Ad position: web_incontent_pos1

Data sources

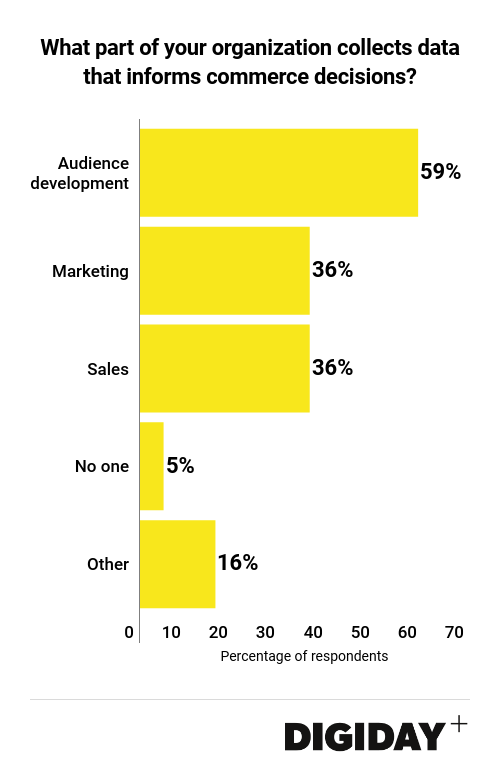

Publishers often have multiple teams providing data to help determine commerce strategies. Forty-one percent of the publishers polled by Digiday at the Hot Topic event said they used data from multiple departments when developing their commerce approach. Fifty-nine percent of respondents said their audience development team was responsible for collecting the data that informs their company’s commerce plans.

GQ found that its views and engagement on its Best Stuff product recommendations vertical outpaced its other product-related editorial content. That success and audience development data encouraged GQ to launch a weekly newsletter featuring Best Stuff recommendations. Futurism also relies on audience data from its top-performing editorial content as the first step in planning new products. Beyond pageviews and traditional engagement metrics, publishers often use SEO and search to glean data. BuzzFeed, for instance, relied heavily on search data to plan an 18-category shopping guide for the 2017 holiday season.

One exception to most publishers is Fusion Media Group, which built a commerce business by exclusively examining sales data. However, Fusion Media Group’s plans to use audience feedback from Facebook groups are a reflection of audience data’s increasing role in informing publishers’ commerce strategies.

More in Media

What publishers are wishing for this holiday season: End AI scraping and determine AI-powered audience value

Publishers want a fair, structured, regulated AI environment and they also want to define what the next decade of audience metrics looks like.

Digiday+ Research Subscription Index 2025: Subscription strategies from Bloomberg, The New York Times, Vox and others

Digiday’s third annual Subscription Index examines and measures publishers’ subscription strategies to identify common approaches and key tactics among Bloomberg, The New York Times, Vox and others.

From lawsuits to lobbying: How publishers are fighting AI

We may be closing out 2025, but publishers aren’t retreating from the battle of AI search — some are escalating it, and they expect the fight to stretch deep into 2026.

Ad position: web_bfu