Save 50% on a 3-month Digiday+ membership. Ends Dec 5.

Digiday Research: Most publishers don’t benefit from behavioral ad targeting

This research is based on unique data collected from our proprietary audience of publisher, agency, brand and tech insiders. It’s available to Digiday+ members. More from the series →

Behavioral targeting was billed by many ad technology companies as a win-win for all parties involved: Advertisers would be able to target their ads to highly-specific audiences, publishers would be able to wring more revenue from their ad inventory as a result, and consumers would see fewer irrelevant ads. But fast-forward a few years and many online publishers are now questioning whether behavioral targeting has done anything to help their businesses at all.

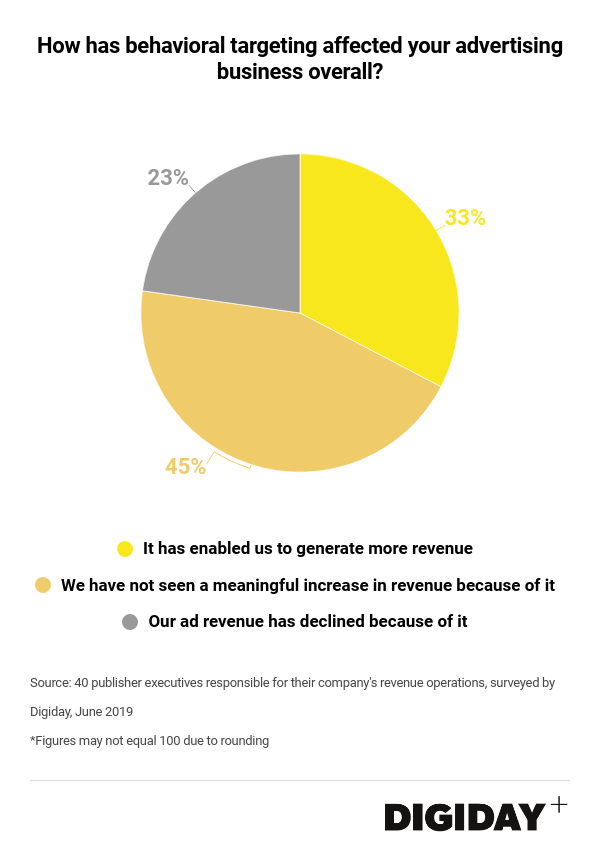

Digiday polled 40 publisher executives responsible for revenue generation at their companies on the impact behavioral ad targeting has had on their overall ad business. Thirty-three percent of respondents said they believe behavioral targeting has resulted in greater ad revenues for their companies. For 45% of respondents, behavioral ad targeting has not produced any notable benefit, while 23% of publisher executives said behavioral targeting has actually caused their ad revenues to decline.

A study on the impact of behavioral ad targeting, first reported on by The Wall Street Journal, has ignited debate around the benefit — or lack thereof — that behavioral targeting can provide publishers. The study found that cookie-targeted ads typically generate only 4% in additional revenue for publishers.

“For the first time, we have empirical research showing that the numerous techniques to track users around the web drive little to no benefit to consumers and publishers,” said Jason Kint, chief executive of publisher trade group Digital Content Next.

But whether or not a publisher sees success from behavioral targeting likely depends on a range of variables, including the type of content they produce, the market they serve, where they get traffic from, the sophistication of their ad tech and more.

“If you’re a premium publisher with incredibly strong advertiser demand, behavioral targeting probably isn’t going to add much to your CPMs,” said one publishing executive. “Buyers are already willing to pay a higher price just to be on your page.”

One recent example of a publisher finding success without behavioral targeting is The New York Times. Digiday previously reported that after the Times turned off behavioral targeting for its advertisers almost immediately following GDPR, the company actually saw its digital ad revenues rise.

Ad position: web_incontent_pos1

“The desirability of a brand may be stronger than the targeting capabilities,” said Jean-Christophe Demarta, svp for global advertising at New York Times International.

As the study cited by the Journal points out, many industry executives believe behavioral targeting fails to deliver more revenue to publishers because any upside is enjoyed by ad-tech middlemen instead of being passed on to publishers. But a third of publishers in Digiday’s poll said they believe it has helped boost their revenues. It’s why many are doing what they can to prepare for a future where browsers like Chrome or Safari could and already do limit their ability to place cookies on readers.

Publishers with a firm grasp of their audience are likely to have a better track record of generating additional revenues through behavioral ad targeting, if advertisers use it. While Chip Schenck, svp of data and programmatic solutions at Meredith acknowledged that revenue from behavioral targeting was constituted a fraction of Meredith’s overall digital revenue, he added, “Our CPMs for audience targeting have been higher (a lot more than 4%) than for contextual targeting, given the uniqueness and performance of our data.”

Certain publishers like retail-specific sites might also be better positioned to benefit from behavioral ad targeting. “Cookie data for e-commerce or shopping-focused publishers remains incredibly important for their ad businesses because of advertisers willing to bid higher on retargeted consumers,” said Premesh Purayil, chief technology officer at Ranker.

Ad position: web_incontent_pos2

The upside of behavioral targeting for some publishers can also be seen in the difference in revenues publishers earn between browsers that allow cookie-targeting and those that do not, according to Paul Bannister, evp of strategy at CafeMedia, which relies heavily on programmatic advertising for its revenues. “We consistently see higher CPMs on Google Chrome than on Apple Safari where cookies are essentially dead,” he said. “So if the question is, do cookies lead to more revenue than the answer is yes. Third-party cookies are what matters,” he added.

Nonetheless, it is extremely difficult for publishers to directly compare the values of an ad bought through behavioral targeting and one that was not. That’s because publishers don’t have access to the data buyers are using to bid on certain inventory. So assessing the value of behavioral ad targeting and drawing succinct conclusions about their effectiveness will remain challenging.

More in Media

What publishers are wishing for this holiday season: End AI scraping and determine AI-powered audience value

Publishers want a fair, structured, regulated AI environment and they also want to define what the next decade of audience metrics looks like.

Digiday+ Research Subscription Index 2025: Subscription strategies from Bloomberg, The New York Times, Vox and others

Digiday’s third annual Subscription Index examines and measures publishers’ subscription strategies to identify common approaches and key tactics among Bloomberg, The New York Times, Vox and others.

From lawsuits to lobbying: How publishers are fighting AI

We may be closing out 2025, but publishers aren’t retreating from the battle of AI search — some are escalating it, and they expect the fight to stretch deep into 2026.

Ad position: web_bfu