Save 50% on a 3-month Digiday+ membership. Ends Dec 5.

Digiday Research: European publishers bet on their own properties for video

This research is based on unique data collected from our proprietary audience of publisher, agency, brand and tech insiders. It’s available to Digiday+ members. More from the series →

When it comes to video distribution, European publishers are increasingly betting on themselves.

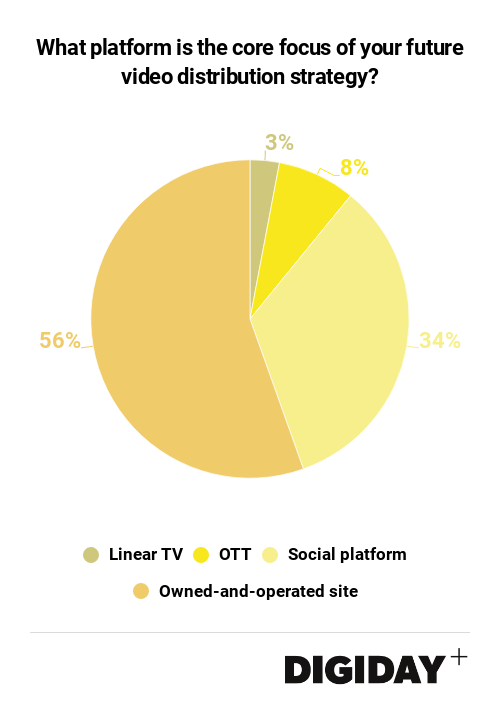

Over half of publishers surveyed at the Digiday Video Summit in Europe this June said their owned and operated properties are their primary focus when it comes to video distribution, over other channels such as social media platforms or over-the-top TV.

From a revenue perspective there’s a clear incentive for publishers to prioritize their own properties, since they’re typically the easiest to monetize successfully, according to previous Digiday research. The obvious advantage to publishers having their videos on their owned sites is that they don’t have to split revenue with platform partners, but that approach also limits their dependency on platforms, distribution partners or other middlemen.

However, even publishers like Hearst UK that are prioritizing their owned platforms still pay considerable attention to their performance on social platforms. The reason is simple: scale. In smaller markets, it can be difficult to amass sustainable audiences, especially when audiences are confined by language.

To rectify the issue of scale, platforms provide an easy solution. Highsnobiety found that thanks to Instagram’s algorithm, publishers’ videos have greater reach than normal posts despite lower engagement. IGTV also offers publishers access to bigger audiences, and UK publishers have been quick adopters.

Platforms also help expose small market publishers to major brand advertisers. Boiler Room distributed video across several platforms including YouTube, its owned site, and IGTV. But because of the exposure it gained on YouTube, Boiler Room allowed it to partner with brands that otherwise may have passed on it, it said.

Ad position: web_incontent_pos1

More in Media

What publishers are wishing for this holiday season: End AI scraping and determine AI-powered audience value

Publishers want a fair, structured, regulated AI environment and they also want to define what the next decade of audience metrics looks like.

Digiday+ Research Subscription Index 2025: Subscription strategies from Bloomberg, The New York Times, Vox and others

Digiday’s third annual Subscription Index examines and measures publishers’ subscription strategies to identify common approaches and key tactics among Bloomberg, The New York Times, Vox and others.

From lawsuits to lobbying: How publishers are fighting AI

We may be closing out 2025, but publishers aren’t retreating from the battle of AI search — some are escalating it, and they expect the fight to stretch deep into 2026.

Ad position: web_bfu