Save 50% on a 3-month Digiday+ membership. Ends Dec 5.

Eighteen months ago, Bloomberg TV made a fundamental change in its approach toward online video. Instead of just taking clips from Bloomberg TV and automatically posting them online, producers in the field were made to consider two questions: Will the segment work on TV, and will it work on the Web?

“The difference between us and a traditional newspaper is that a publisher has to back into something that looks like TV,” Chris Berend, Bloomberg’s executive producer and head of video development, told Digiday. “Our TV infrastructure is the greatest advantage we have, so we use it.”

And this digital-first approach is paying off.

In July, Bloomberg had its best month ever in terms of global unique visitors and streams, even outpacing competitor Dow Jones. According to comScore, Bloomberg saw 5.2 million global uniques (2 million in the U.S) and 27.4 million global video streams (7.6 million in the U.S) compared to Dow Jones’ 4.8 million global uniques (1.8 million U.S) and 13.8 million global video streams (4.6 million U.S).

In November, the first month comScore tracked Bloomberg, the site had 1.3 million uniques.

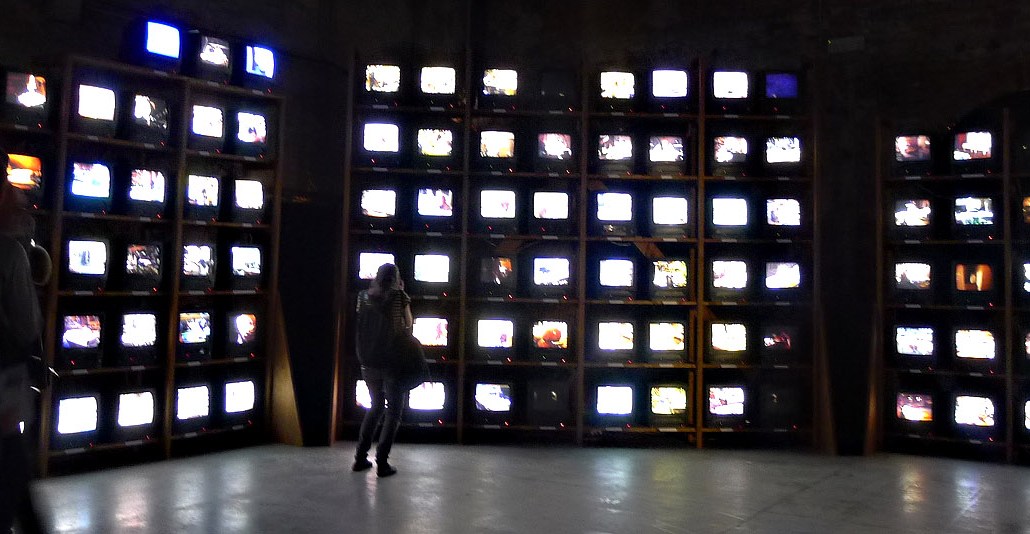

Bloomberg has production teams in New York, London and Asia, which together create an eye-popping 200 pieces of video content every day, both streaming video and video on demand. These segments – which run online – can be as short as 22 seconds, like this clip of an exuberant freshman convocation speech, or as long as an hour, which is the duration of its “Charlie Rose Show.” Most sit between 1 and 3 minutes. This piece about the future of TV, for example, clocks in at a 1:25. Here’s a 1:41 piece about the four types of missiles that could fly over Syria.

Berend describes Bloomberg video as falling into one of three categories: breaking news; a middle space not pegged to news “but in the conversation”; and the trends space, connecting the dots of the zeitgeist for its audience.

As a result of all this investment, video has become a serious revenue generator. According to sources, Bloomberg charges roughly $75 CPMs for video, which is much more than the $15 CPMs it typically gets for dot-com content. A Bloomberg spokesperson said that CPMs on dot-com can reach as high as $90. Trevor Fellows, head of ad sales for Bloomberg Media, said this combination of pre-roll and company units works well together.

“The challenge we have is that video is so popular. We have a lot of it, but demand is greater than supply,” Fellows said. “People are prepared to pay impressive prices. When you look at the performance over the banner, video represents great value.”

Bloomberg content is surrounded by three ad units, a pre-roll ad and two banners that appear at the same time the video is being watched. On the live stream, there are pre-roll and mid-rolls.

But even that might not be enough. Brad Adgate, a svp of research at Horizon, who often appears as an expert on Bloomberg, believes that Bloomberg isn’t taking advantage of advertising during live streams.

“I get the same ads over and over again,” Adgate said. “I think there’s an opportunity there.”

Bloomberg’s justification for its high rates is that there is a dearth of high-quality, trustworthy video out there.

“We have a TV team making good-looking video,” Fellows said. “Look at new players in the space; you can see videos are badly lit, jerky, and it’s an enormous difference. We have that advantage. It’s expensive to gather from scratch. A lot of advertisers are coming in because there’s not much high-quality video being produced.”

But there are many competitors that are getting more deeply involved in online video, and not just traditional news outlets like the New York Times. BuzzFeed, for example, is building out a budding video network (its YouTube channel has 768,000 subscribers), and it has partnered with CNN to create a CNNBuzzFeed YouTube channel. But Berend said the BuzzFeeds of the world don’t scare him.

“We think about our close competitive set, outlets who appeal to thought leaders,” Berend said. “It’s about knowing our audience really well and press their buttons and compel them when I think they’re ready to be compelled. It’s a futile game to play against the Internet at large.”

Image via Flickr

More in Media

What publishers are wishing for this holiday season: End AI scraping and determine AI-powered audience value

Publishers want a fair, structured, regulated AI environment and they also want to define what the next decade of audience metrics looks like.

Digiday+ Research Subscription Index 2025: Subscription strategies from Bloomberg, The New York Times, Vox and others

Digiday’s third annual Subscription Index examines and measures publishers’ subscription strategies to identify common approaches and key tactics among Bloomberg, The New York Times, Vox and others.

From lawsuits to lobbying: How publishers are fighting AI

We may be closing out 2025, but publishers aren’t retreating from the battle of AI search — some are escalating it, and they expect the fight to stretch deep into 2026.

Ad position: web_bfu