Save 50% on a 3-month Digiday+ membership. Ends Dec 5.

Pinterest is the sleeping giant of social commerce, but it might want to look to Polyvore for tips on making money.

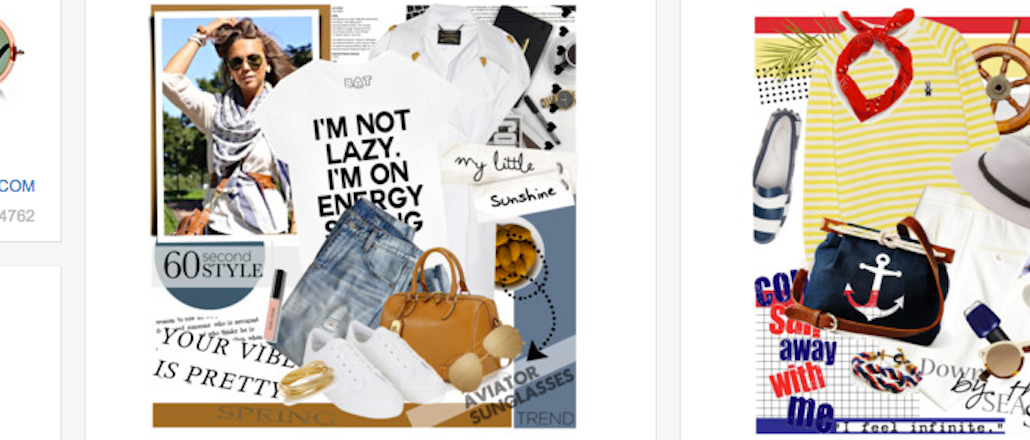

Polyvore, which launched in 2007, has been profitable for the past four years. It’s done that by expanding on fashion and beauty into the home goods vertical, driving sales for e-commerce sites (the average shopping basket generated by Polyvore users is worth $200) and adopting cost-per-click advertising.

Now, the company is rolling out a native ad unit, called promoted trends, that will allow brand advertisers to place their products in the “What’s Trending Now” section at the top of the site’s main page. When users click on a sponsored fashion trend, like “maxi skirts,” they’ll be sent directly to the retailer’s site to shop the skirts. Other trends, curated by Polyvore, send shoppers elsewhere on the site when clicked.

Pinterest, which draws comparisons to Polyvore as an inspiration- and image-driven platform, has taken its time when it comes to monetizing. Its native ads are less than a year old: Pinterest launched a beta program from Promoted Pins in May of 2014; in January, it rolled out the complete version to all advertisers.

It’s impossible to compare Polyvore and Pinterest when it comes to scale. Pinterest, with about 72 million monthly unique visitors, serves many interests and verticals like food, travel, art and sports, has raised $1.1 billion in funding and is valued at $11 billion. Polyvore, with a little over 5 million monthly unique visitors, lets fashion and beauty fans shop, create outfit collages and discover new trends, and has raised $22 million in funding, most recently in 2011.

“We have a very good starting point for native monetization,” said Arnie Gullov-Singh, Polyvore’s chief operating officer. “If people are looking at products, then the ad unit is a product. If they’re looking at trends, the ad unit is a trend. It’s just adding to what they came to do.”

As Pinterest enters native advertising, it might end up borrowing from Polyvore’s current model, which brings in ad dollars without distracting from the user experience.

Ad position: web_incontent_pos1

Even if a promoted product or trend on Polyvore doesn’t suit a user’s taste, it doesn’t run the risk of irrelevancy. All products on Polyvore are shoppable somewhere on the Internet, and the brands that advertise on the site fit in with the products that are already there, unsponsored.

“Nobody goes to the site with the expectation of an independent, church-and-state experience,” said Susan Bidel, senior analyst at Forrester. “They go there with the mindset to purchase already, so it’s perfectly in keeping with what the consumer would expect.”

Pinterest, instead, has to figure out how to make native ads relevant, rather than disruptive, for its nearly 80 million users, who might be there for recipes, funny quotes or style inspiration. So far, it largely hasn’t: Even with its huge valuation, Pinterest hasn’t made a sizable amount of money; its Promoted Pins ad unit is still in its early stages. Instead, it has focused its first five years on building a dedicated user base, and one billion user-created boards later, it’s safe to say it has. Pinterest did not return requests for a comment.

“Pinterest has a lot of opportunities because it’s in so many spaces,” said Dave Surgan, director of mobile and social platforms at R/GA. “So it has to approach advertising a lot more carefully. With native, there’s a largely negative connotation, because it needs to be done right and thought through to not be interruptive.”

Ad position: web_incontent_pos2

According to Gullov-Singh, Polyvore’s users aren’t just uninterrupted by native advertising, they’re responding to it. He said that they see a 6-to-1 return on ad spend, which to him signifies success. By comparison, Google’s return is 4-to-1, and the major social media sites (Facebook, Twitter and Instagram) average a 2.6-to-1 return.

Even though Polyvore’s focus on retail is just a small piece of the Pinterest pie, it’s finding ways to grow. Recently, it launched a stand-alone app, Polyvore Remix, which helps users build digital outfits suited to their personal taste. The app has not monetized yet, but Gullov-Singh said that will be the next step after the app grows usership. It is too early to pull any data, but on Polyvore’s site and main app, users have created 150 million outfits so far.

“It’s much more niche,” said Surgan of Polyvore compared to Pinterest. “But they’re using community activity in interesting ways, like creating trend reports for brands. They’re creating value.”

Surgan said that Polyvore is seen as an influential platform for brands, which is important when most consumers are gaining inspiration from influencers, like bloggers and Instagrammers, and not from advertisements.

For Pinterest, monetization through native advertising will be about targeting the niche communities within the greater platform. In the Promoted Pins limited beta release, brands from varied verticals — like Gap, Kraft, Walt Disney and ABC Family — tested the advertising.

“It will be interesting to see how Pinterest grows its revenue model, and on which verticals it ends up placing bets,” said Surgan. “It likely won’t be all of them.”

And if Pinterest wants to monetize its retail vertical, it will be able to pull inspiration from Polyvore.

More in Marketing

Ulta, Best Buy and Adidas dominate AI holiday shopping mentions

The brands that are seeing the biggest boost from this shift in consumer behavior are some of the biggest retailers.

U.K. retailer Boots leads brand efforts to invest in ad creative’s data layer

For media dollars to make an impact, brands need ad creative that actually hits. More CMOs are investing in pre- and post-flight measurement.

Ad position: web_bfu