Save 50% on a 3-month Digiday+ membership. Ends Dec 5.

How HQ trivia competitors are differentiating their marketing

Live trivia app HQ has taken the world by storm, with nearly 2 million people tuning into every live game. Imitators like The Q, FleetWit and Under Armour’s Stephen Curry-themed live trivia app have cropped up to cash in on the momentum. But now they’re realizing they have to differentiate their marketing from HQ’s.

After gaining popularity through word-of-mouth, HQ got its first sponsorships from big companies like Nike and Warner Bros. Winners got special HQ-Nike shoes, while Warner Bros. got to promote its “Ready Player One” film. HQ also uses celebrity influencers like Jimmy Kimmel, The Rock and Robert DeNiro to promote and host games with large cash prizes.

The Q (short for The Question), launched in December, has also moved into branded sponsorships, running sponsored games with the Dallas Mavericks, Fox Sports, MLB and NCAA basketball.

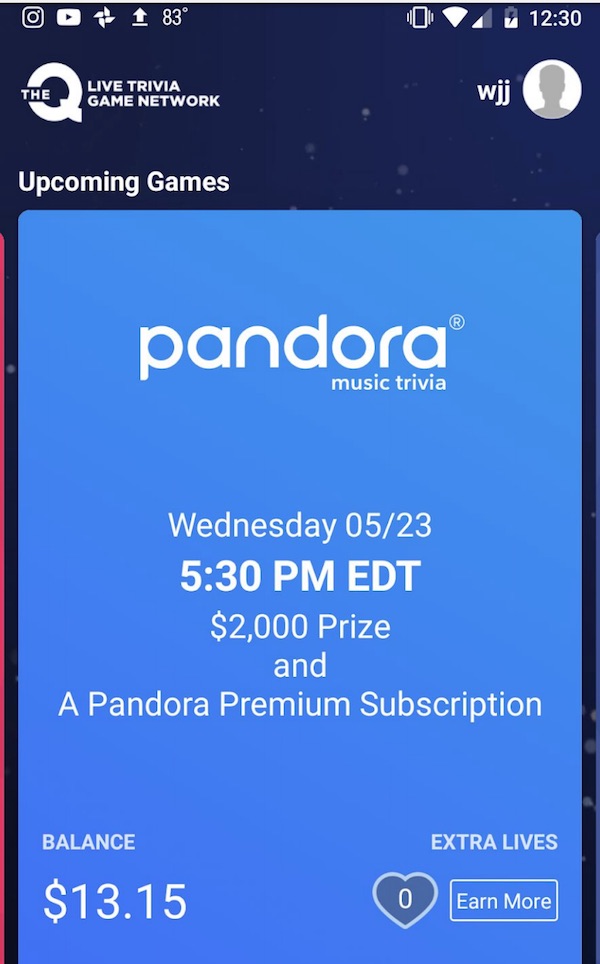

To set itself apart, starting this week, The Q is selling its technology to brands and publishers to produce their own live trivia games. The first company on board is music-streaming service Pandora, which bought a time slot on May 23 at 5:30 p.m. Eastern time and is offering winners a $2,000 prize and annual premium subscriptions (worth $120). Other publishers are in line to produce their own shows, too. “Our strength is not in creating the shows,” said The Q’s CEO Will Jamieson, “it’s the technology behind it.”

The idea is to set The Q apart by making shows for specific audiences. Pandora, for instance, is producing a show that contains only music-related trivia. “Trivia and music is such a natural marriage,” said Bill Crandall, vp of editorial content at Pandora. “Trivia players are among the most engaged audience on mobile, which is also true of passionate music fans.”

The Q has a category-specific leaderboard where players can win prizes in categories like pop culture and geography even after they are eliminated from a live game, an option that HQ does not offer.

Ad position: web_incontent_pos1

The Q is also looking overseas for users, with an app in India and a beta version for several European countries. Jamieson said India is already The Q’s largest market, with around 100,000 people tuning in per game.

As for Under Armour’s Steph IQ live trivia game, its focus is on male basketball fans between ages 13 and 18. It goes live when the Golden State Warriors’ Stephen Curry makes his first 3-point shot in an upcoming game. To connect with that audience, the app gives away prizes like Warriors tickets and Under Armour merchandise. Gen Z influencer Bdot hosts the trivia game, and Under Armour promotes the app through Curry’s social channels, the NBA and Foot Locker.

FleetWit, meanwhile, has gone the route of a pay-to-play strategy, influencer marketing and offering trivia around the clock. FleetWit, which has gotten 140,000 users since launching in August, is selling an ad-free experience. For instance, for a live trivia game that offers $500 as a cash prize for winners to split, it costs $100, or 400 credits, to register. The result is there are fewer players, but more opportunity to win a higher cash prize.

Unlike HQ, which is aligning itself with movie and TV show stars, FleetWit is partnering with trivia world celebrities like Ken Jennings, 2014 winner of “Who Wants To Be a Millionaire”; “Jeopardy!” 2017 winner Buzzy Cohen; and Mark Labbett, star of TV quiz show “The Chase” to create videos.

“We believe that everybody is an expert at something, and we use our partnerships to tell that story,” said Mary Zakheim, director of marketing at FleetWit.

More in Marketing

Ulta, Best Buy and Adidas dominate AI holiday shopping mentions

The brands that are seeing the biggest boost from this shift in consumer behavior are some of the biggest retailers.

U.K. retailer Boots leads brand efforts to invest in ad creative’s data layer

For media dollars to make an impact, brands need ad creative that actually hits. More CMOs are investing in pre- and post-flight measurement.

Ad position: web_bfu