Digiday Research: Snapchat is the hardest platform to advertise on

This research is based on unique data collected from our proprietary audience of publisher, agency, brand and tech insiders. It’s available to Digiday+ members. More from the series →

Both brands and media buyers believe Snapchat is the hardest platform to advertise on, according to new Digiday research.

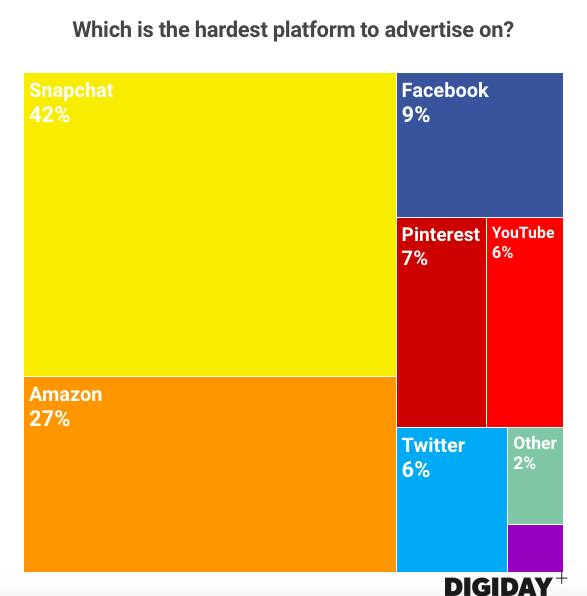

In a survey of 63 media-buying executives at the Digiday Media Buying Summit earlier this month in New Orleans, Snapchat was chosen as the most difficult platform to advertise on, with 42 percent of respondents selecting it as the most challenging platform, while 27 percent chose Amazon and 9 percent picked Facebook. This mirrors earlier Digiday research from the Digiday Marketing Summit in December, where 28 percent of brand marketers indicated Snapchat was the most challenging platform to advertise on, ahead of Pinterest, Instagram and Twitter.

One media buyer at this month’s summit complained that “Snapchat’s platform [user interface] is difficult to use.” A common pain point for media buyers with Snapchat is measuring campaign performance. One respondent claimed it is “hard to track performance and lift,” while another voiced frustrations about the “lack of deep insights, ad options and tracking.”

Reliably targeting users on Snapchat has caused headaches for some media buyers. Alcohol brand Diageo had to pull its ads off the platform after discovering ads may have been shown to users under the legal drinking age.

Ad position: web_incontent_pos1

All news for Snapchat hasn’t been bad, though. It recently beat Wall Street analysts’ projections and its self-service ad-buying platform has made buying ad campaigns easier, according to 16 media buyers Digiday previously interviewed. Some media buyers, such as Jeremy Sigel, global svp of partnerships and emerging media for WPP’s Essence believes the app redesign will benefit advertisers as well.

Media buyers’ gripes about Amazon similarly focused on transparency. One media buyer at this month’s summit said that “Amazon’s managed service has little transparency,” while another complained that “[Amazon] is not a self-serve friendly platform.”

Like Snapchat, Amazon is making efforts to improve its $1.7 billion ad business. Amazon is testing new attribution tools that will better measure campaign results. But for Craig Atkinson, PHD’s chief investment officer, Amazon already delivers on metrics. Speaking at a Digiday+ members event last month, he said, “[Amazon] just [kills] it on the metrics. If you’re a [consumer goods] company, you know exactly what happened.”

Ad position: web_incontent_pos2

A common complaint about Amazon is the lack of support it gives ad buyers, who have described it as a “sinkhole.” But none of the ad buyers who selected Amazon as the hardest platform to advertise on in Digiday’s March survey mentioned customer support as the reason for their selection.

Check out our earlier research on how clients’ brand-safety concerns are affecting media buyers’ digital strategies here. Learn more about our upcoming events here.

More in Marketing

In the marketing world, anime is following in the footsteps of gaming

As marketers look to take advantage of anime’s entry into the zeitgeist, they might be wise to observe the parallels between the evolution of anime as a marketing channel and the ways brands have learned to better leverage gaming in recent years.

With the introduction of video ads and e-commerce, Roblox looks to attain platform status

Roblox is expanding into more areas than just ads in 2024. Much like platforms such as Amazon and Facebook have transcended their origins to evolve from their origins as online marketplaces and social media channels, Roblox is in the midst of a transformation into a platform for all elements of users’ virtual lives.

PepsiCo wants to remain a ‘driver of culture’ as it turns to influencers and activations amid rebrand

The soda-maker says it can translate cultural relevance into sales volume.

Ad position: web_bfu