Save 50% on a 3-month Digiday+ membership. Ends Dec 5.

Digiday Research: European marketers see GDPR hurting audience targeting

This research is based on unique data collected from our proprietary audience of publisher, agency, brand and tech insiders. It’s available to Digiday+ members. More from the series →

At the Digiday Programmatic Marketing Summit Europe last month in Portugal, we sat down with 52 brand and agency marketers to learn how satisfied they are with their audience-targeting capabilities. Check out our earlier research on the use of artificial intelligence in marketing here. Learn more about our upcoming events here.

Quick takeaways:

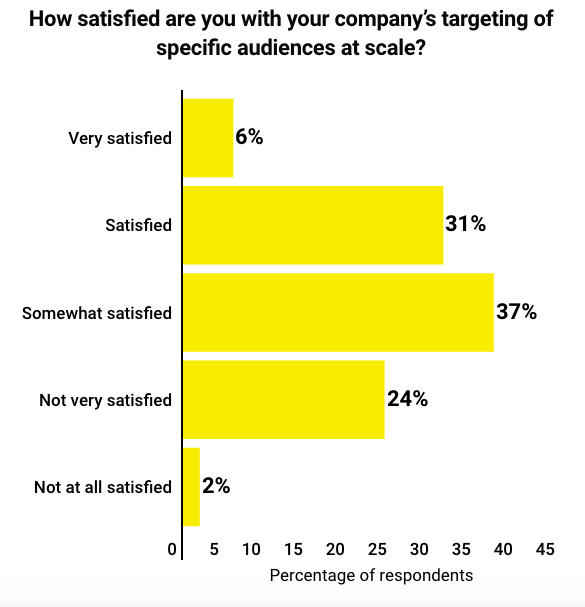

- Only 37 percent of marketers in Digiday’s survey from the event are satisfied with their ability to target audiences at scale.

- Marketers’ most common fear about the General Data Protection Regulation is a decreased ability to target consumers.

Marketers in the U.S. and in Europe aren’t thrilled with their ability to target audiences at scale. Just 37 percent of European marketers surveyed at the Digiday Programmatic Marketing Summit Europe said they are satisfied with their audience-targeting abilities, while Digiday’s previous research found that 40 percent of U.S. marketers are satisfied.

Outside of Google and Facebook, European marketers lack options for places they can reliably reach consumers at scale. Amassing scalable audiences is difficult in a multilingual continent like Europe. According to a 2012 report requested by the European Commission (the most recent data available), just 38 percent of people in Europe speak English, the most common language spoken in the European Union.

In an effort to compete with the duopoly and improve marketers’ targeting abilities, publishers and broadcasters are forming alliances. By pooling inventory for marketers, companies hope to solve the issue of scale, while making it easier for marketers to target consumers. Such alliances have struggled in the past, however, so marketers are justified in their doubts.

Outside of coalitions, individual publishers are also working to improve their ad-targeting capabilities for advertisers. Forbes introduced geolocation and audience-targeting services to its branded content offerings. The New York Times, meanwhile, says it’s experimenting with new ways to use its audience data to enhance ad targeting. While these efforts might address the issue of reliably targeting users, publishers still offer a mere fraction of the scale offered by Facebook and Google.

Media transparency also plays a role in marketers’ lack of satisfaction with audience targeting. As marketers become more nuanced in the analytics behind their digital campaigns, the lack of reliable metrics is making them question whether the money they spend on ads reaches their target audiences.

Ad position: web_incontent_pos1

And the General Data Protection Regulation, which takes effect May 25, will likely hinder audience targeting. Forty-two percent of marketers surveyed by Digiday said their biggest GDPR worry is a decreased ability to target consumers.

Research from PageFair found that over half of consumers would reject all online tracking unless it’s necessary for services they request, and 81 percent would reject tracking from third parties. That would significantly reduce the data marketers can use to target consumers and further exacerbate marketers’ existing problem.

GDPR will also harm Facebook’s ability to serve users targeted ads based on their interests. Facebook already surprised marketers by shutting down its Partner Categories program that let marketers use third-party data on consumers to better target users on Facebook’s platform. The increasing restrictions on user data imposed by GDPR will likely cause marketers to become less satisfied with their ability to target consumers at scale in the coming months.

More in Marketing

Ulta, Best Buy and Adidas dominate AI holiday shopping mentions

The brands that are seeing the biggest boost from this shift in consumer behavior are some of the biggest retailers.

U.K. retailer Boots leads brand efforts to invest in ad creative’s data layer

For media dollars to make an impact, brands need ad creative that actually hits. More CMOs are investing in pre- and post-flight measurement.

Ad position: web_bfu