Save 50% on a 3-month Digiday+ membership. Ends Dec 5.

After years of being ignored, customer service is back en vogue. You’ll hear nothing but paeans to its importance at industry conferences and from execs eager to seem with it — not to mention, loath to find their companies the subject of viral hits like the agonizing Comcast customer service call.

But it turns out that a laser focus on customer service might not be the best approach for top executives, at least if they’re focused on stock performance, which they inevitably are. A new report from research firm Forrester analyzed five industries and found no correlation between high customer service marks and strong corporate performance — at least when it comes to market returns.

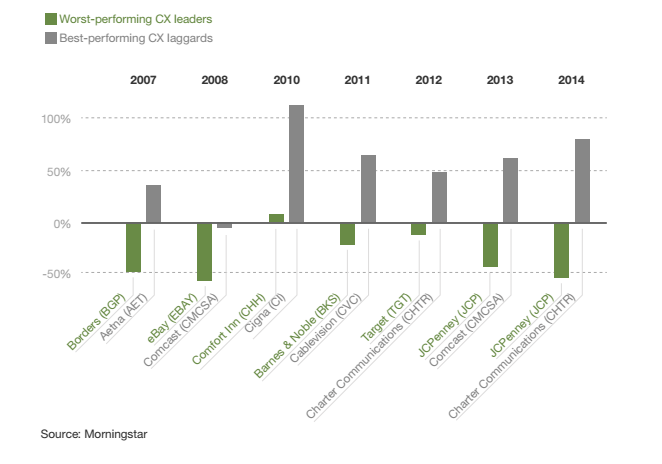

Borders and JCPenney both lead the pack in terms of customer experience, but both tanked when it came to stock returns. JCP’s stock returns in particular were down 43 percent and 54 percent in 2013 and 2014 respectively. (Borders, for its part, shut down entirely but was apparently still beloved by customers.)

But surely companies that ranked poorly when it came to customer service suffered in the stock market too, right? Not quite: Companies that got low marks in customer service — like Cigna, Charter Communications and, yes, Comcast — did really well in the market.

But while most prior research has focused on stock performance as the key performance metric to figuring out how well brands do, Forrester research found that it’s not enough.

“Too many factors affect stock performance for anyone to be able to isolate just the effects of customer experience over time,” said Harley Manning, who authored the research. Manning said to think of it like an experiment where there are too many variables at play to make the experiment worthwhile.

Ad position: web_incontent_pos1

“In many industries, the ‘companies’ you want to analyze are not companies at all but business units of companies,” which also complicates the results. In the case of Comcast, “cable” is only one of five business-reporting units within the wider company. So the ticker symbol CMCSA doesn’t give you a full picture.

That means revenue growth, not stock performance, might be a more-worthwhile metric to look at.

Competing companies that have different scores on consumer service rankings (very high or very low) find that their revenue growth now correlates with customer experience. AT&T’s U-verse, which is one of the highest-scoring ISPs when it comes to how well they treat their customers, has a much stronger revenue growth than it biggest competitor, Comcast.

JetBlue Airways, a brand that has consistently said that customer experience is its biggest priority, is the top airline in Forrester’s “CX Index.” Compared with United, JetBlue’s revenue grew five times faster — 8.9 percent over three years, compared with 1.6 percent for United. The same was true in other industries like financial management.

Ad position: web_incontent_pos2

In retail, customer experience has a fuzzier role — most companies, competitors or not, have very similar customer service scores, said Manning. That’s because it’s so competitive that stores that don’t provide good CX ultimately just die. But e-commerce has changed the game: online retailers generally do better on customer experience because they provide good selection and convenience.

“Once you start thinking in terms of a holistic customer experience instead of a series of seemingly unconnected parts, you begin to realize what traditional retailers need to do in order to compete,” said Manning. “Things like bringing in higher-quality store associates who can improve both the effectiveness and ease of the experience, as well as engender positive emotions among customers.”

More in Marketing

Ulta, Best Buy and Adidas dominate AI holiday shopping mentions

The brands that are seeing the biggest boost from this shift in consumer behavior are some of the biggest retailers.

U.K. retailer Boots leads brand efforts to invest in ad creative’s data layer

For media dollars to make an impact, brands need ad creative that actually hits. More CMOs are investing in pre- and post-flight measurement.

Ad position: web_bfu