Save 50% on a 3-month Digiday+ membership. Ends Dec 5.

This is the first article in a series on “The Arrival of Social Commerce,” a look at how smart UI, product offerings and closing the loop on the purchase cycle can help — and who is doing it right.

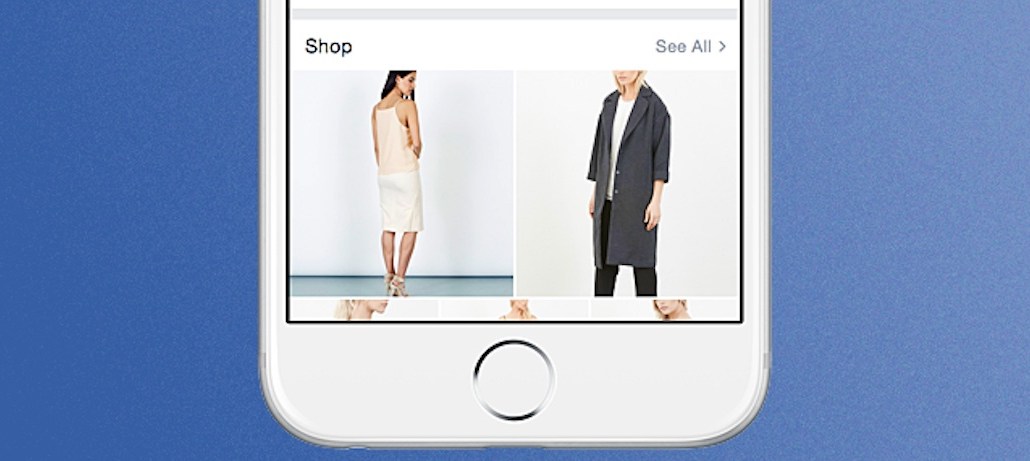

On Thursday, Facebook announced there will be a new way for users to shop on its platform. By testing a “shop” tab that will sit alongside the “about” section of a brand’s Facebook page, the company is taking a deeper dive into keeping online commerce within its walls.

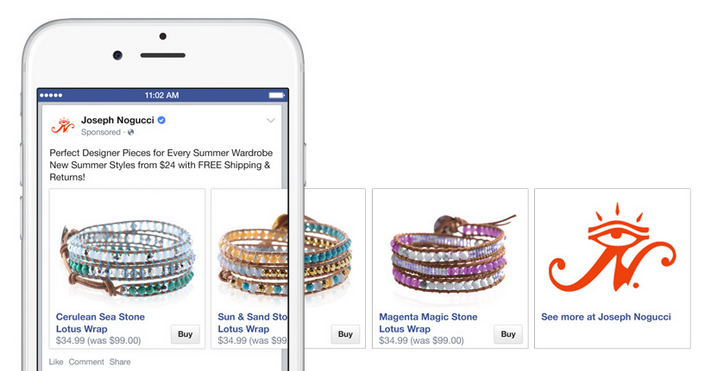

Facebook is far from alone in this: Buy buttons litter social platforms, as the leading players — Twitter, Pinterest, YouTube, Instagram and Snapchat, along with Google — put one-click-to-buy buttons as close to users as possible.

This isn’t Facebook’s first buy button, either. Its first, released in June, is a shoppable ad that appears users’ newsfeeds. The new feature is a shoppable selection, essentially a miniature store, on a retailer’s Facebook page — it won’t pop up in your feed even if you’ve liked the brand.

Shoppable pages have more to them than a single button users click to shop. Here’s what brands should know.

It’s more than just a buy button.

Facebook rolled out a buy button in June; that click-to-buy function is attached to sponsored ads on the platform’s homepage. Shoppable pages aren’t ads, they live on individual retailer’s Facebook accounts.

“The shoppable Facebook pages look great,” said Rony Zeidan, founder of the branding agency Ro New York. “If you’re browsing, it’s not overly marketed or surrounded by advertising.”

Ad position: web_incontent_pos1

The shop function, rather than a button, more resembles an excerpt of the retailer’s e-commerce store. Within that mini-store is a collection of buy buttons accompanying the items the brand is featuring on Facebook. All transactions will happen within Facebook’s walls. Like they did with Facebook’s buy button, Shopify is partnering with the platform for beta testing.

Mobile transactions could be huge, but data ownership will still be blurry.

The function could be great for making mobile transactions less tedious and more instantaneous. Buy buttons for stand-alone products on platforms like Pinterest depend on a perfect storm: they must strike the consumer at the right time with the exact right product for them to buy. A collection of items from a single retailer means a user has more options under the same click-to-buy umbrella.

“This is what’s becoming the norm — the instant access of everything. It seems like a natural progression for them to make the next step a fully customized selection,” said Ryan Fishman, interactive marketing manager at 1-800-Flowers.

Facebook, on mobile, is a major power player. According to a Forrester report, the app owns 13 percent of overall time spent on mobile. This is great for retailers looking to get facetime on mobile, but it also means that, as with all buy buttons, ownership of consumer information gets blurry.

Ad position: web_incontent_pos2

“So far, there’s little discussion as to who actually owns the customers,” said ShopStyle evp Anna Feiler. “Essentially, retailers are handing the reigns to Facebook. So for retailers with an existing, loyal customer base who have things figured out, they should be cautious.”

Paid reach will likely play a big part in making sales.

In 2014, Facebook struck a blow to brand engagement by nixing organic reach. If a brand wants valuable time in front of its followers on their newsfeeds, they have to pay for it — so unless they do the same to get people to their shoppable pages, it’s likely no one will know they’re there.

“My concern is that we have no data on how often fans visit a brand’s page,” said Erin Dwyer, svp of global e-commerce and social at Haven Beauty. “The newsfeed is where consumers spend a majority of their time. Will we use it and test it? Absolutely, but I don’t have high hopes that it will be a new contender in the conversion space, since I have no clue what our pageviews are at this point.”

At this point, Facebook says it’s not taking a cut of sales that happen on the app, but if brands want any sales to take place, they’ll have to pay to point eyeballs to their new shops.

It’s a risk-versus-reward call for retailers.

Shoppable pages will sit better for retailers with more to gain and less to lose.

“For retailers that don’t necessarily have a ton of brand equity and not a lot of loyal followers, it’s a no brainer,” said Feiler. “For retailers with an existing consumer-base who have all that figured out, I think they should be more cautious. I wouldn’t want to hand my customer relationship to Facebook.”

As Facebook tests the function, it’s too early to tell how truly seamless the consumer experience is, which will answer a lot of retailers’ questions about its worth.

“It’s risk versus reward: you might be able to drive sales at a reasonable cost,” said Joe McCaffrey, head of social at Huge. “But it will take a while before all the technology on the e-commerce side, like inventory, is integrated. There’s a lot of value there, but only if it works.”

At the end of the day, retailers might not be able to afford to resist.

Mobile is the next frontier for retailers, and if Facebook can unlock seamless transactions, retailers could miss out if they opt out.

“I am curious at what happens, but the end result is they are matching the ideas of the newer generation of thought — singularity and immediacy,” said Fishman.

Mobile commerce is projected to make up just 10 percent of e-commerce transactions in 2015, according to Forrester, but the research leading up to purchases on mobile is a major factor. Retailers don’t know what to do with that information, and while they might be hesitant to hand the power to Facebook, it might be the best solution — at least for now.

“Facebook already does too much,” said Zeidan. “But now, people are more accepting of that. This is a chance for retailers to get ahead on mobile, where they have very little visibility.”

More in Marketing

Ulta, Best Buy and Adidas dominate AI holiday shopping mentions

The brands that are seeing the biggest boost from this shift in consumer behavior are some of the biggest retailers.

U.K. retailer Boots leads brand efforts to invest in ad creative’s data layer

For media dollars to make an impact, brands need ad creative that actually hits. More CMOs are investing in pre- and post-flight measurement.

Ad position: web_bfu